Introduction

The construction industry operates on a complex web of regulations, and few are as critical- or as frequently misunderstood- as prevailing wage laws. Anyone dealing with federally or state-funded public works projects, including contractors, subcontractors, and project owners, must know and obey these laws. If companies do not follow these standards, they might face harsh fines, harm their image, set back timelines, and be banned from further public contracts. When profits are tight, and rivalry is strong in construction, managing how to deal with prevailing wage rates can turn a company’s success into trouble.

This guide will examine prevailing wage laws and provide advice and tips to ensure your business follows the rules, avoids costly penalties, and maintains a positive reputation. We will discuss the basic ideas, the most common mistakes to avoid, and important tips needed by any company in the public construction sector.

Understanding the Foundation of Prevailing Wage Laws

These laws exist to support local wages, which the government projects might have lowered. The Davis-Bacon and Related Acts (DBRA), enacted in 1931, are now the best-known federal prevailing wage law. In many states, the regulations for projects funded by these states are based on the federal Davis-Bacon Act.

In essence, anyone hired to work on public projects with prevailing wage must ensure their laborers and mechanics are at least paid the local minimum wage and standard fringe benefits. To determine this, the U.S. DOL assesses federal projects, measuring wages for similar work in the area, and state agencies look at wages for state work through surveys.

What Constitutes a Prevailing Wage?

A prevailing wage rate isn’t just a single hourly figure. It’s a combination of:

- Introductory Hourly Rate: The cash wage paid directly to the worker.

- Fringe Benefits: These can include health insurance, retirement plans, vacation pay, holiday pay, and other bona fide benefits. Fringe benefits can be paid directly to the worker in cash or contributed to an approved plan.

It’s crucial to remember that the prevailing wage determination specifies rates for various labor classifications (e.g., electrician, plumber, laborer, carpenter). Misclassifying workers is a standard error that leads to violations.

Who Do Prevailing Wage Laws Apply To?

Prevailing wage laws apply to:

- Contractors: The primary contractor awarded the public works project.

- Subcontractors: Any firm the primary contractor hires to perform a portion of the work.

- Laborers and Mechanics: All individuals performing manual labor on the project site, regardless of their skill level or how they are paid (e.g., hourly, piece rate). This often includes truck drivers who spend a “significant amount of time” on the job site.

Navigating the Complexities: Key Compliance Areas

Achieving and maintaining compliance with prevailing wage laws requires meticulous attention to detail across several critical areas.

Accurate Wage Determinations: The Starting Point

The prevailing wage rates for a project are provided in the wage determination issued by the contracting agency. This document is the cornerstone of your compliance efforts.

- Obtain the Correct Wage Determination: Ensure you have the most current and accurate wage determination for your specific project and geographic location. These can change periodically, so verify before bidding and throughout the project.

- Understand the Classifications: Carefully review the listed labor classifications and their corresponding wage and fringe benefit rates. Do not assume your company’s internal job titles align perfectly with federal or state classifications.

- Address Unlisted Classifications: If a required labor classification is not listed in the wage determination, you must initiate a process to request an additional classification and wage rate from the contracting agency and the DOL (for federal projects). This must be done before assigning work to that classification.

Payroll Documentation: Your Primary Defense

Accurate and complete payroll records are your best defense in the event of an audit or investigation.

- Certified Payroll Reports: For federal projects, contractors and subcontractors must submit weekly certified payroll reports (Form WH-347) to the contracting agency. Each report shows each worker’s name, job type, hours worked that day, wage payment, and benefits received. Although every state has different requirements, the requirements often include basic but detailed reporting.

- Record Retention: All payroll records, including timecards, pay stubs, canceled checks, and fringe benefit documentation, must be retained for at least three years after the project’s completion and, in some cases, longer, depending on state regulations.

- Accurate Hour Tracking: Implement robust systems for tracking employee hours, differentiating between work performed on prevailing wage projects and non-prevailing wage projects. Overtime hours must also be calculated correctly according to federal and state labor laws and prevailing wage requirements.

Fringe Benefits: The Often-Overlooked Component

Fringe benefits are a common area of non-compliance due to their complexity.

- Bona Fide Benefits: Ensure that any benefits counted towards the prevailing wage fringe benefit requirement are “bona fide.” This generally means they are provided to the worker or contribute to a plan for the worker’s benefit. Examples include health insurance premiums, contributions to qualified retirement plans, and certain paid leave.

- Annualization of Benefits: Be cautious with benefits like vacation or holiday pay earned over a year but only used periodically. These may need to be “annualized” or calculated to determine their hourly equivalent for prevailing wage purposes.

- Cash in Lieu of Benefits: If you don’t provide the full amount of fringe benefits as specified, you must pay the difference directly to the worker in cash. This “cash in lieu” payment is subject to all applicable payroll taxes. Clearly document these payments on certified payroll.

Posting Requirements: Transparency is Key

Contractors are typically required to prominently display the applicable wage determination and a poster outlining worker rights (such as the “Employee Rights Under the Davis-Bacon Act” poster) at the job site. This ensures workers are aware of their entitlements. Failure to post can result in penalties.

Common Pitfalls and How to Avoid Them

Understanding where others have stumbled can provide invaluable lessons for your own compliance strategy.

- Worker Misclassification: As mentioned, misclassifying a skilled laborer as an unskilled one (e.g., paying a journeyman electrician as a laborer) is a frequent and costly error. Always verify classifications against the wage determination.

- Inadequate Record Keeping: Poorly maintained or incomplete records make it impossible to demonstrate compliance during an audit. This includes missing timecards, inconsistent payroll data, or insufficient documentation for fringe benefits.

- Failure to Pay Fringe Benefits Correctly: This can involve not providing the full amount of fringe benefits, providing non-bona fide benefits, or failing to pay “cash in lieu” when benefits don’t meet the requirement.

- Incorrect Overtime Calculation: Prevailing wage requirements do not supersede the Fair Labor Standards Act (FLSA) or state overtime laws. Overtime must be paid on the total regular rate, which includes the basic hourly rate and any cash in lieu of benefits.

- Ignoring Subcontractor Compliance: The primary contractor is ultimately responsible for the compliance of their subcontractors. Vetting subcontractors, requiring them to submit certified payroll, and conducting regular checks are essential.

- Assuming Uniformity Across Projects/States: Prevailing wage rates and state-specific requirements vary significantly. What’s compliant in one state or on one project may not be in another. Always check the specific wage determination and state laws for each project.

- Lack of Internal Training: Even well-intentioned employees can make costly errors without proper training. Ensure your payroll, HR, and project management teams are fully versed in prevailing wage requirements.

Real-World Case Studies by Fusion Assist

Examining actual enforcement actions highlights the severe consequences of non-compliance and underscores the importance of a robust compliance program.

Case Study 1: Misclassification and Underpayment of Wages

Scenario

A mid-sized mechanical contractor was awarded a federal project. The company routinely classified plumbers performing complex pipefitting as “pipefitters’ helpers” to pay lower wages than mandated by the prevailing wage determination for plumbers. They also failed to provide the full fringe benefit amount, paying only a portion in cash.

Investigation and Outcome

During a routine DOL audit, discrepancies were found between the work performed and the classifications on the certified payrolls. Interviews with workers confirmed they were performing skilled plumbing tasks but were paid at a lower rate. The company also lacked proper documentation for its fringe benefit contributions. The DOL ordered the company to pay over $300,000 in back wages and liquidated damages to the affected workers. The company faced significant legal fees and reputational damage and was temporarily barred from bidding on federal contracts.

Lesson Learned

Accurate classification is paramount. Do not try to cut corners by misclassifying workers. Invest in proper job classification training and regularly compare duties against the wage determination. Ensure all fringe benefits are properly documented and bona fide.

Case Study 2: Subcontractor Non-Compliance and Prime Contractor Liability

Scenario

A large general contractor (GC) hired a small electrical subcontractor for a public school renovation project. The GC provided the prevailing wage determination to the subcontractor and requested certified payrolls. However, the GC did not consistently review the submitted payrolls for accuracy or conduct site visits to verify worker classifications and hours. The subcontractor, struggling financially, began underpaying its electricians and laborers, pocketing the difference.

Investigation and Outcome

The state labor department received a complaint from a subcontractor employee. An investigation revealed systemic underpayment by the subcontractor. Crucially, because the GC failed to exercise due diligence in monitoring its subcontractor’s compliance, the GC was held jointly liable for a significant portion of the back wages, totaling $150,000. While the subcontractor bore the primary responsibility, the GC’s failure to ensure compliance of its downstream partners resulted in substantial financial loss and a stain on its reputation.

Lesson Learned

Prime contractors are ultimately responsible for subcontractor compliance. Implement a rigorous subcontractor vetting process that includes reviewing their past prevailing wage compliance. Establish clear contractual obligations regarding prevailing wage, require regular submission of certified payrolls, and actively monitor compliance through site visits and random checks.

Case Study 3: Inadequate Fringe Benefit Documentation

Scenario

A roofing contractor on a municipal project paid its employees a competitive basic hourly rate but relied heavily on contributions to a company-sponsored 401(k) plan to meet the fringe benefit requirement. During an audit, the auditor requested proof of the 401(k) contributions and their allocation to individual employees on an hourly basis. The contractor had only annual contribution statements and could not demonstrate how the contributions directly correlated to the hours worked on the prevailing wage project.

Investigation and Outcome

The DOL deemed the benefits unpaid because the contractor could not adequately document that the 401(k) contributions satisfied the hourly fringe benefit obligation for the prevailing wage work. The contractor was required to pay tens of thousands of dollars in back wages to cover the shortfall in fringe benefits, plus penalties.

Lesson Learned

Document every aspect of fringe benefit compliance. For benefits like 401(k)s or health insurance, be prepared to demonstrate the hourly equivalent of the contribution and how it directly benefits the worker for hours worked on the prevailing wage project. Work with your payroll provider or benefit administrator to ensure proper tracking and reporting.

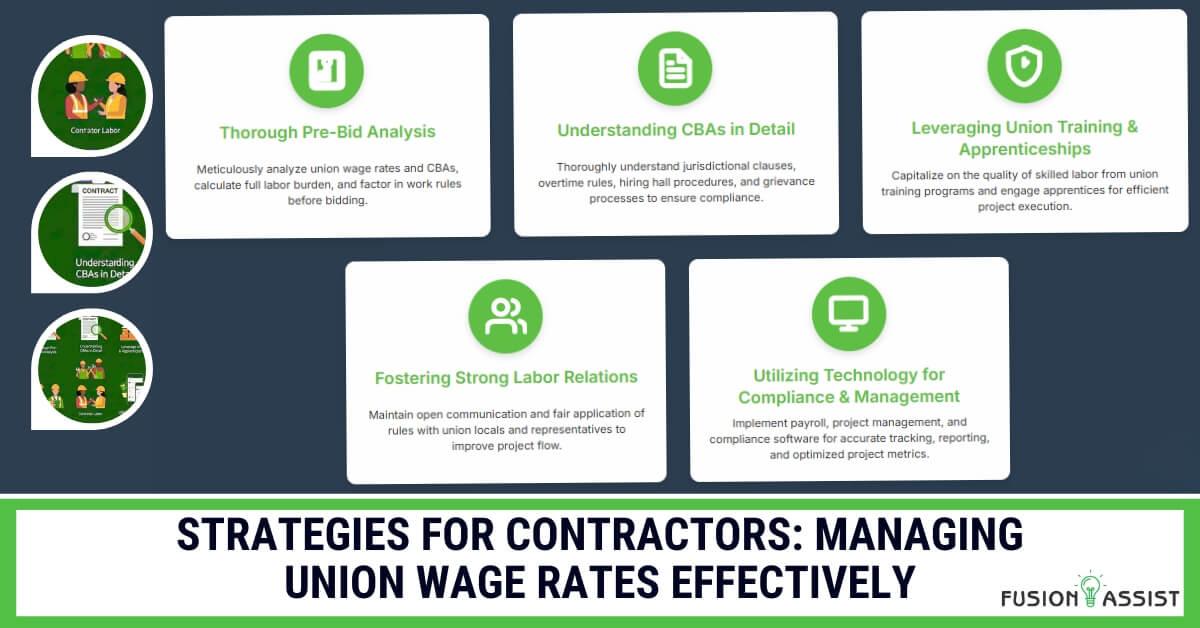

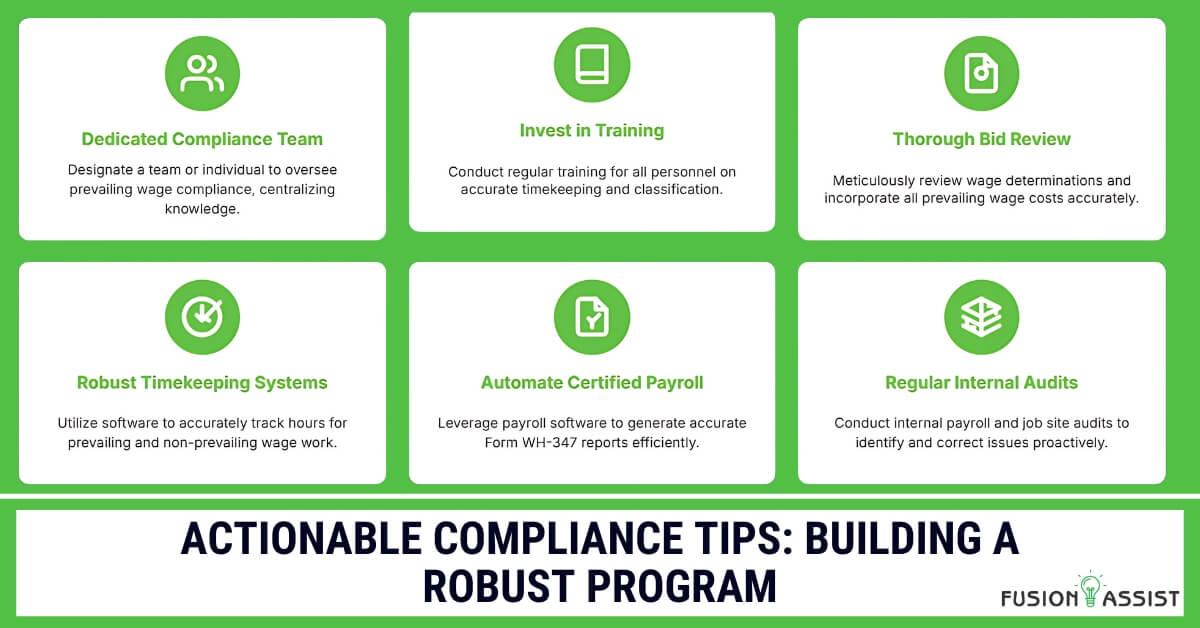

Actionable Compliance Tips: Building a Robust Program

Proactive measures are the most effective way to avoid penalties. Consider implementing the following:

- Establish a Dedicated Compliance Team/Officer: Designate an individual or a team responsible for overseeing prevailing wage compliance. This centralizes knowledge and ensures consistent policy application.

- Invest in Training: Conduct regular training sessions for all relevant personnel: project managers, superintendents, HR, payroll staff, and field supervisors. Emphasize the importance of accurate timekeeping and classification.

- Thorough Bid Review: Before submitting a bid, meticulously review the wage determination for the project. Incorporate prevailing wage costs (including all basic wages and fringe benefits) accurately into your bid to avoid underbidding.

- Pre-Construction Meeting with Subcontractors: Before work begins, hold a mandatory meeting with all subcontractors to review prevailing wage requirements, discuss certified payroll submission, and clarify expectations for compliance.

- Implement Robust Timekeeping Systems: Utilize timekeeping software or systems that differentiate between prevailing and non-prevailing wage work and accurately track hours by day and by classification.

- Automate Certified Payroll Submission: Leverage payroll software that can generate certified payroll reports (Form WH-347) accurately and efficiently, reducing manual errors.

- Regular Internal Audits: Conduct internal audits of your payroll records and job site practices to identify and correct potential compliance issues before they escalate.

- Stay Informed: Prevailing wage laws and wage determinations are subject to change. Subscribe to updates from the DOL and relevant state labor agencies. Attend industry seminars and workshops.

- Legal Counsel Consultation: When in doubt, consult with legal counsel specializing in labor and employment law or prevailing wage compliance. Proactive legal advice can save substantial costs down the line.

- Develop a Compliance Manual: Create an internal compliance manual outlining your company’s policies and procedures for prevailing wage adherence. This serves as a valuable resource for all employees.

Frequently Asked Questions (FAQs)

Q1: What is the difference between federal and state prevailing wage laws?

A: While both federal (Davis-Bacon and Related Acts) and state (“Little Davis-Bacon” acts) prevailing wage laws aim to ensure fair wages on public works projects, they differ in jurisdiction, specific requirements, and the agencies responsible for enforcement. Laws from the federal government cover projects supported by federal money, and state or local laws cover projects supported by state or local money. Wage requirements, the forms to use, and enforcement methods can be quite different from one state to another. You should find out which legal rules are relevant to your project and follow them all.

Q3: Can I pay less than the prevailing wage if my employees agree?

A: No. An agreement between an employer and employee to pay less than the prevailing wage is not legally binding and will not excuse non-compliance. Preventing wage laws sets a minimum wage for certain projects, and it cannot be changed even with individual deals. Should the parties agree only to a reduced amount, the contract would be useless, and the employer would have to pay the full wage plus any back payments and charges.

Q3: How do I handle multi-state projects with different prevailing wage requirements?

A: Dealing with multi-state projects means carefully observing the various wage laws in each state. Correct wage requirements in each state and for every project need to be obtained and followed. The result is that wages, types of work, reporting forms, and record requirements can be different in many places. To appreciate and meet all applicable rules, it’s best to have expertise within the company or to work with a specialized consultant.

Q4: What are the potential penalties for non-compliance?

A: The penalties for prevailing wage non-compliance can be severe and multifaceted. They include:

- Back Wages: Payment of all underpaid wages and fringe benefits to affected workers.

- Liquidated Damages: Often an additional amount equal to the back wages.

- Fines and Civil Penalties: Monetary penalties imposed by regulatory agencies.

- Debarment: Being barred from bidding on or receiving future public contracts for a specified period (typically three years for severe violations).

- Reputational Damage: Losing trust from government agencies and potential clients harms the company’s ability to get new business in the future.

- Legal Fees: Investigations and lawsuits often mean high costs for legal services.

Q5: What should I do if I discover a prevailing wage violation within my company?

A: Discovering a breach of the prevailing wage rule means acting as quickly as possible.

- Stop the Violation: You should not use the non-compliant practice anymore.

- Assess the Damage: Determine the scope of the violation, including the number of affected employees and the total amount of underpayments.

- Calculate Back Wages: Calculate every back wage and benefit owed to you.

- Self-Report (If Applicable): Consider voluntarily disclosing the violation to the relevant labor department. In some cases, voluntary disclosure can reduce penalties.

- Remediate: Pay the back wages and implement corrective measures to prevent future occurrences.

- Review and Revise: Strengthen your internal compliance procedures and train staff to ensure future adherence.

- Seek Legal Counsel: Talk to an experienced prevailing wage attorney to lead you through the steps and help you avoid legal risks. When you fix issues in advance, it proves your goodwill and helps cut down the seriousness of penalties.

Conclusion

Complying with prevailing wages is important for public construction work and makes running your business easier and honestly. With a good grasp of the rules, proper internal checks, and constant attention to potential problems, contractors, and subcontractors have the confidence to follow prevailing wage laws. A strong commitment to following the rules protects finances, shields your reputation, and helps your business become a reputable partner in public work initiatives. If you teach your team well, keep good records, and monitor the company, you can protect yourself from big penalties, improve your workplace, and help achieve more fairness in construction.

Take Action Now: Don’t wait for an audit to discover compliance gaps. Review your prevailing wage practices, train your team, and implement the strategies this guide outlines. Contact Fusion Assist, a prevailing wage compliance specialist, to ensure your company is fully prepared for every public works opportunity.