Introduction

In the construction industry, accurate cost estimation is critical to the success of any project, especially those subject to prevailing wage laws. Misestimating labor costs on public works or government-funded jobs can lead to compliance issues, budget overruns, and even legal penalties. This is where partnering with a prevailing wage estimation specialist becomes invaluable.

In this comprehensive guide, we explore why engaging a prevailing wage estimation expert is essential for successful project execution. From avoiding compliance risks to enhancing bid accuracy and increasing profitability, we delve into every aspect of this niche yet crucial service.

What is Prevailing Wage?

Prevailing wage is the hourly wage, usual benefits, and overtime paid to the majority of workers in a specific trade or occupation within a particular geographic area. It is often mandated by federal, state, or local governments for publicly funded projects.

Key Concepts

Davis-Bacon Act: A federal law requiring contractors on public works projects to pay laborers and mechanics no less than the locally prevailing wages and fringe benefits.

State Prevailing Wage Laws: Vary from state to state, adding complexity to wage calculations.

Certified Payroll Reporting: Requires accurate documentation of wages paid on qualifying projects.

Understanding these concepts is essential for staying compliant and competitive in public sector construction.

The Importance of Prevailing Wage Estimation

Challenges of Prevailing Wage Estimation

Prevailing wage estimation involves more than just multiplying hours by rates. A minor miscalculation can result in serious financial and legal consequences.

Common Issues Contractors Face

- Complex and changing wage determinations by jurisdiction

- Inaccurate classification of labor roles

- Failure to account for fringe benefits

- Time-consuming compliance documentation

- Bid inaccuracies leading to profit margin erosion

Contractors must navigate a maze of variables to ensure accuracy, making the need for a specialist increasingly important.

What Does a Prevailing Wage Estimation Specialist Do?

A prevailing wage estimation specialist is an expert in applying prevailing wage rules to construction projects. Their core responsibility is to ensure every labor cost in your estimate reflects current prevailing wage laws and classifications.

Specialist Tasks Include

- Reviewing and interpreting government wage determinations

- Accurately classifying workers based on the scope of work

- Calculating base wages and fringe benefits

- Preparing detailed labor cost breakdowns

- Advising on compliance and risk mitigation

Benefits : Why You Should Partner with a Prevailing Wage Estimation Specialist

In the high-stakes world of public construction projects, the accuracy of your labor cost projections can determine whether your bid wins, your margins hold, and your company remains compliant. Partnering with a prevailing wage estimation specialist offers significant advantages, ensuring your project aligns with regulatory standards while optimizing costs and resources. Below are the key benefits, each expanded with actionable insights and implementation strategies.

1. Expertise and Accuracy

Accurate Wage Determination

A prevailing wage estimation specialist brings deep expertise in identifying the correct wage classifications and applying them accurately to your project. They stay updated on current federal, state, and local prevailing wage regulations and ensure your estimates reflect the latest wage determinations, including fringe benefits.

This level of accuracy prevents under- or over-estimating labor costs, which is critical for both compliance and profitability.

Implementation Steps

- Stay Updated with Regulations: Regularly monitor changes from the Department of Labor (DOL), SAM.gov, and local labor boards.

- Detailed Job Classification Analysis: Break down your project’s labor scope and assign the correct job roles to avoid misclassification.

- Fringe Benefit Application: Calculate and apply fringe benefits properly—cash equivalents, health insurance, training funds—to meet legal obligations.

2. Ensure Regulatory Compliance and Risk Mitigation

Avoid Legal Penalties

Non-compliance with prevailing wage laws can lead to serious consequences, including:

- Heavy fines

- Repayment of back wages

- Disqualification from future public projects

A specialist ensures that your wage practices meet all relevant laws by accurately classifying jobs and maintaining detailed wage records. This proactive compliance significantly lowers your risk during audits.

Implementation Steps

- Conduct Compliance Audits: Schedule routine audits to ensure all practices are legally sound.

- Maintain Documentation: Keep certified payrolls, wage determination references, and classification logs accessible and audit-ready.

- Implement Reporting Systems: Use digital tools for real-time payroll reporting and compliance tracking.

3. Improve Bidding Accuracy

Confident and Competitive Bids

One of the most valuable contributions of a prevailing wage specialist is enhancing your bid accuracy. Estimating labor costs under prevailing wage rules is complex, and inaccurate bids can result in thin or negative profit margins.

By leveraging specialist expertise:

- Labor costs are estimated using up-to-date wage rates, including expected increases.

- Bid estimates reflect the true costs of executing the work under public project guidelines.

- You reduce the chance of pricing yourself out of competition—or underbidding and absorbing losses.

Implementation Steps

- Detailed Labor Cost Projections: Generate labor cost projections by specific job classifications and locations.

- Include Wage Adjustments: Anticipate mid-project wage changes or new determinations.

- Build Flexible Budgets: Include contingency allowances for unexpected wage-related expenses.

4. Effective Cost Management and Optimization

Better Budget Control

Misestimated wages can quickly drain project budgets. A prevailing wage estimation specialist helps you forecast labor costs precisely and identify cost-saving opportunities without compromising compliance or quality.

This gives you a more accurate view of where your money is going and where it can be saved, resulting in tighter cost control and stronger project financials.

Implementation Steps

- Use Precise Estimates: Integrate accurate labor costs into your project plan to prevent overages.

- Identify Optimization Areas: Look for efficiencies in crew assignments, labor staging, or fringe management.

- Track Cost Deviations: Monitor labor costs against your estimate throughout the project to stay on budget.

5. Save Time and Internal Resources

Focus on Core Operations

Prevailing wage estimation requires specialized knowledge, constant research, and hours of administrative work. Outsourcing this function allows your internal team to focus on what they do best—project execution, client management, and quality control.

Implementation Steps

- Delegate Compliance Tasks: Let the specialist handle wage calculations, classification, and documentation.

- Centralized Labor Data: Use integrated systems your specialist manages to streamline reporting and approvals.

- Optimize Project Planning: Free up project managers from estimation duties so they can focus on delivery and client satisfaction.

6. Support for Project Budgeting

Reliable Labor Cost Forecasting

Accurate labor projections are critical for developing realistic budgets. A prevailing wage specialist breaks down job roles, calculates applicable wages, and accounts for factors like seasonal rate changes and benefit requirements.

This level of insight improves your ability to:

- Submit realistic budgets to clients or funding agencies

- Justify budget adjustments with documented labor data

- Prevent labor-related financial overruns

Implementation Steps

- Wage Breakdown by Trade: Provide itemized wage estimates for all labor categories.

- Account for Rate Fluctuations: Integrate potential increases or government updates mid-project.

- Include a Contingency Fund: Buffer your budget with a margin for unforeseen compliance adjustments.

7. Ongoing Expert Support and Consultation

Informed Decision-Making

Prevailing wage estimation is not a one-time task—it evolves throughout the project lifecycle. A specialist provides continuous consultation, helping you interpret wage determination changes, manage reclassification issues, and address compliance concerns promptly.

Their insights can also guide strategic decisions for future bids and contracts.

Implementation Steps

- Regular Strategy Calls: Schedule monthly or milestone-based review meetings.

- Quick-Response Consultations: Get immediate help on classification or compliance questions.

- Training and Guidance: Educate your project managers and finance team on best practices with the specialist’s help.

8. Boost Profit Margins

Protect and Improve Financial Performance

You gain stronger control over your margins with better accuracy, compliance, and time management. You’re less likely to encounter cost overruns, fines, or unexpected labor expenses—all of which erode profitability.

By optimizing labor forecasts and managing costs proactively, specialists help protect your margins on public sector work.

9. Gain a Strategic Competitive Advantage

Win More Public Bids

Public sector construction is fiercely competitive. Being known for accurate and compliant bids can give you a significant edge.

With a specialist on your side:

- You can turn around complex bids faster

- You’re more likely to meet bid requirements without revision

- Your reputation as a compliant, reliable contractor grows

This positions your firm as a go-to option for municipalities and public agencies

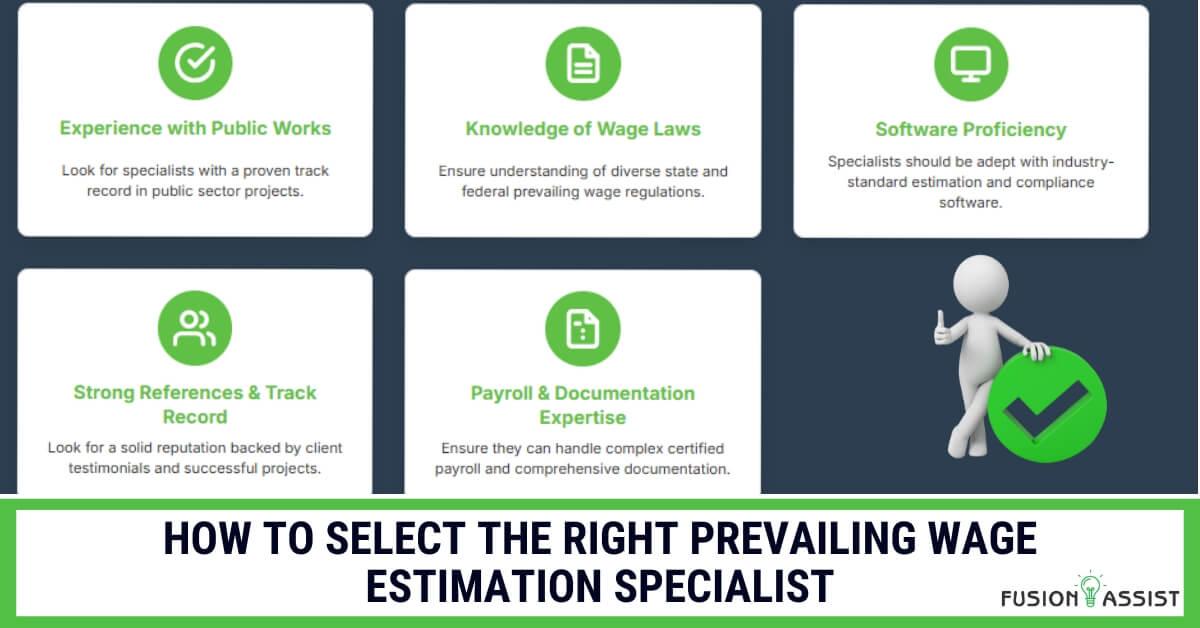

How to Select the Right Prevailing Wage Estimation Specialist

Not all estimation providers are created equal. Choosing a qualified specialist can make or break your project success.

What to Look For

- Experience with public works projects in your region

- Understanding of multiple state and federal wage laws

- Proficiency with estimation software and tools

- Strong references or proven track record

- Ability to handle certified payroll and documentation

Tools and Technologies Used in Prevailing Wage Estimation

Prevailing wage estimation specialists use a range of tools to ensure accuracy and efficiency.

Common Tools Include

- RSMeans and other cost databases

- Prevailing wage data from SAM.gov or state labor boards

- Construction estimation platforms like PlanSwift, ProEst, or Sage Estimating

- Payroll compliance tools like LCPtracker or eMars

These technologies streamline the process, minimize errors, and support compliance reporting.

Internal Teams vs. External Specialists

Pros of Hiring an Internal Estimator

- In-house control and faster communication

- Familiarity with your specific business model

Pros of Outsourcing to a Specialist

- Specialized knowledge of prevailing wage laws

- Broader market experience

- No need for constant training or legal updates

- Scalable resource for project surges

Recommendation: For most small to medium-sized contractors, outsourcing is more efficient and cost-effective than hiring a full-time in-house expert

Industry Trends and the Future of Prevailing Wage Estimation

With increasing public investment in infrastructure, the demand for prevailing wage specialists is growing.

Key Trends

- Increased use of AI in estimation software

- Automated wage updates and alerts

- Integration of compliance tools into project management systems

- More rigorous audits by state and federal agencies

Staying ahead of these trends ensures you’re always compliant and competitive.

Real-World Case Study: Fusion Assist’s Success in Prevailing Wage Estimation

Project Overview

Fusion Assist partnered with a mid-sized general contractor bidding on a $12M municipal library project in California.

Challenges Faced

- Complex prevailing wage requirements across 4 labor classifications

- Tight bid submission timeline

- Uncertainty about fringe benefit allocation

Solutions Implemented

- Conducted a detailed labor breakdown using California DIR data

- Identified fringe benefit overlap with union contributions

- Provided a fully compliant, itemized labor estimate within 72 hours

Outcome

- Bid was successfully submitted and won

- Contractor completed the project under budget

- No compliance violations during post-project audit

Fusion Assist’s expert involvement helped the client win the contract, protect margins, and maintain full compliance

FAQs

What is a prevailing wage estimation specialist?

A prevailing wage estimation specialist is a professional who ensures accurate labor cost estimates on public construction projects by applying the correct wage determinations and compliance standards.

Why is prevailing wage estimation important for public projects?

Strict wage laws govern public projects. Accurate estimation helps avoid compliance issues, underbidding, and financial loss.

Can I handle prevailing wage estimation in-house?

Yes, but it requires up-to-date legal knowledge, dedicated resources, and time. Outsourcing to a specialist is often more efficient and accurate.

What industries need prevailing wage estimators?

Construction, electrical, mechanical, HVAC, and plumbing contractors frequently require prevailing wage estimators for public sector bids.

How does Fusion Assist support prevailing wage estimation?

Fusion Assist provides specialized cost estimation services tailored to prevailing wage projects, ensuring compliance, accuracy, and fast turnaround.

Conclusion

Partnering with a prevailing wage estimation specialist is a smart, strategic move for any contractor involved in public construction projects. From avoiding compliance pitfalls to improving bid precision and maximizing profit margins, the benefits are numerous.

As government investment in infrastructure continues to rise, now is the time to ensure your business is equipped with the right expertise. Whether you’re a general contractor or a specialty trade expert, prevailing wage estimation is not just a necessity—it’s a competitive advantage.

Ready to streamline your prevailing wage estimation process and submit winning bids? Partner with Fusion Assist and gain expert insights, fast turnaround, and complete compliance on every public project.