Introduction

For any contractor engaging in construction projects, a clear understanding of union wage rates isn’t just an advantage—it’s a necessity. These rates, often perceived as complex and rigid, fundamentally impact your project bids, budgets, and overall profitability. Navigating the nuances of union construction demands an insight into collective bargaining agreements, fringe benefits, and the broader economic landscape.

This guide is designed to demystify union wage rates for contractors. We’ll explore their components, how they’re determined, their impact on your projects, and effective strategies for managing them. By the end, you’ll have a solid foundation for making informed decisions when considering hiring union labor.

What Defines Union Wage Rates?

At their core, union wage rates are the compensation standards for a skilled workforce operating under a collective bargaining agreement (CBA). These rates are distinct from individual employment contracts, representing terms negotiated between a labor union and employers (or employer associations).

The Core of Collective Bargaining Agreements (CBAs)

A CBA is a legally binding contract that outlines the terms and conditions of employment for all workers covered by that agreement. For contractors, understanding the CBA is paramount, as it dictates far more than just hourly pay. Key aspects of a CBA include:

- Wage Scales: Specific hourly pay rates for different job classifications (e.g., journeyman electrician, apprentice carpenter, foreman).

- Fringe Benefits: Mandatory employer contributions for benefits like health insurance, retirement plans, and training.

- Work Rules: Detailed rules regarding hours of work, overtime, holidays, shifts, jurisdictional boundaries between trades, and grievance procedures.

- Hiring Procedures: Often dictates that labor must be sourced through union hiring halls or referral systems.

- Term of Agreement: The duration for which the rates and rules are valid, usually multiple years.

Components of a Union Wage Rate

A union wage rate is rarely just a single hourly figure. It’s a comprehensive package that includes several components, all contributing to the total labor cost for the contractor.

1. Base Hourly Wage

This is the direct cash payment made to the worker for each hour worked. It’s the most straightforward component and is typically set at a standardized, higher rate than typical non-union wages in the region.

2. Comprehensive Fringe Benefits

These are mandatory employer contributions that significantly add to the overall cost. Unlike a non-union setting where benefits might be optional or structured differently, CBAs specify exact contributions to various funds. Common fringe benefits include:

- Health and Welfare Fund: Covers health insurance premiums for the worker and often their family.

- Pension Fund: Contributions to a retirement plan, ensuring long-term financial security for the worker.

- Annuity Fund: Additional retirement savings plan, often a defined contribution plan similar to a 401(k).

- Training Fund: Contributions that finance the union’s apprenticeship programs and ongoing journeyman training, ensuring a pipeline of skilled workers.

- Vacation/Holiday Fund: Contributions that accrue to provide paid time off for workers.

3. Other Employer Contributions

Beyond direct wages and fringe benefits, contractors may also be required to contribute to other funds or pay specific fees as part of the union agreement. These can include:

- Industry Promotion Funds: Contributions to support the unionized sector of the industry.

- Administrative Dues/Fees: Payments to cover union administrative costs.

- Workers’ Compensation: While not unique to union projects, calculations for workers’ comp are based on the higher total compensation (wages + benefits), making them higher.

Understanding this full spectrum of costs is critical for accurate project budgeting when working with union construction.

How Union Wage Rates Are Determined

The determination of union wage rates is a dynamic process rooted in collective bargaining and influenced by a variety of economic and market factors.

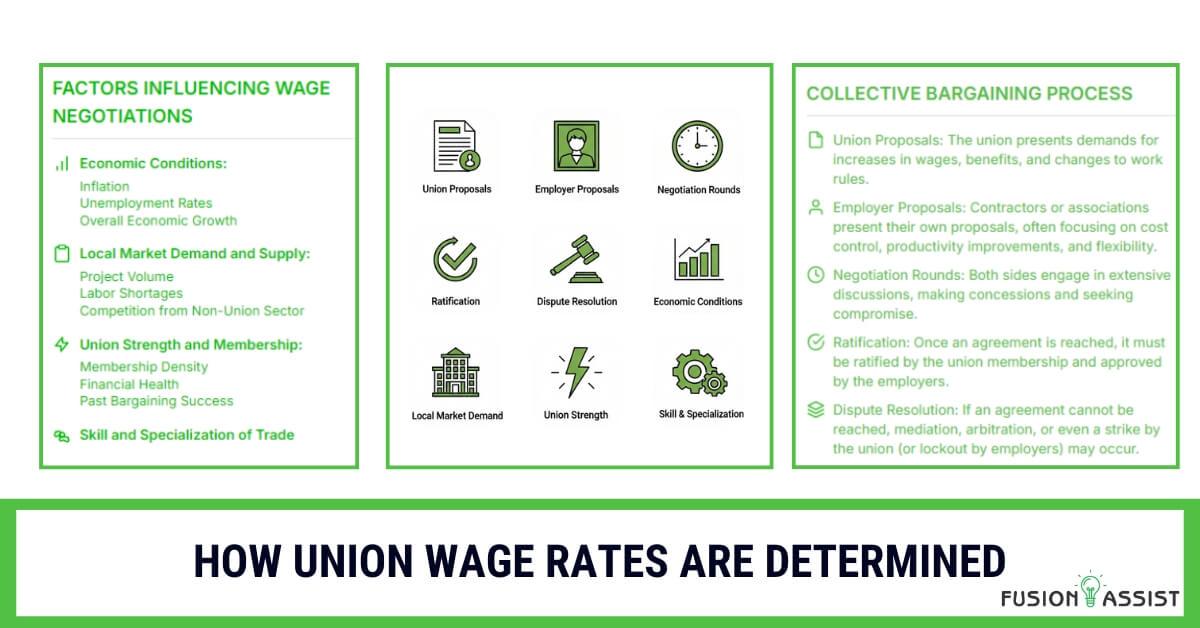

Collective Bargaining Process

Union wage rates are established through negotiations between the union local (representing the workers) and signatory contractors or contractor associations (representing the employers). This process, known as collective bargaining, occurs periodically, typically every three to five years, when the existing CBA expires.

Key aspects of the bargaining process include:

- Union Proposals: The union presents demands for increases in wages, benefits, and changes to work rules.

- Employer Proposals: Contractors or associations present their own proposals, often focusing on cost control, productivity improvements, and flexibility.

- Negotiation Rounds: Both sides engage in extensive discussions, making concessions and seeking compromise.

- Ratification: Once an agreement is reached, it must be ratified by the union membership and approved by the employers.

- Dispute Resolution: If an agreement cannot be reached, mediation, arbitration, or even a strike by the union (or lockout by employers) may occur.

Factors Influencing Wage Negotiations

Several critical factors influence the outcome of union wage rate negotiations:

Economic Conditions:

- Inflation: Unions will often seek wage increases that keep pace with or exceed the rate of inflation to maintain their members’ purchasing power.

- Unemployment Rates: High unemployment in the construction sector can weaken the union’s bargaining position, while low unemployment strengthens it.

- Overall Economic Growth: A robust economy with strong demand for construction projects generally leads to higher wage demands.

Local Market Demand and Supply:

- Project Volume: High demand for construction projects in a specific region can increase the demand for a skilled workforce, pushing union wage rates higher.

- Labor Shortages: Scarcity of particular trades or skills gives unions more leverage in negotiations.

- Competition from Non-Union Sector: A strong non-union presence in the market can temper union demands as employers seek to remain competitive.

Union Strength and Membership:

- Membership Density: A higher percentage of unionized workers in a given trade or region gives the union more power.

- Financial Health: A strong union treasury can sustain members during a strike, strengthening their resolve in negotiations.

- Past Bargaining Success: A history of successful negotiations can build confidence and influence future demands.

Skill and Specialization of Trade:

- Highly specialized trades requiring extensive training (e.g., welders, crane operators, complex electrical technicians) often command higher union wage rates due to the scarcity and value of their skills.

- The duration and intensity of apprenticeship programs reflect the investment in skill development, influencing wage expectations.

Understanding these underlying factors helps contractors anticipate potential wage changes and prepare for future negotiations.

Navigating Union Wage Rates on Public Works Projects: The Prevailing Wage Connection

For contractors involved in public works, union wage rates often intersect with prevailing wage laws. These laws require contractors and subcontractors to pay local union scale or an equivalent rate for workers on government-funded projects.

Davis-Bacon Act and State Prevailing Wage Laws

In the United States, the federal Davis-Bacon Act mandates that contractors and subcontractors on federal projects over $2,000 pay laborers and mechanics no less than the local prevailing wages and fringe benefits. Many states have similar “Little Davis-Bacon” acts for state-funded projects.

- Wage Determinations: The U.S. Department of Labor (DOL) issues wage determinations for federal projects, while state labor agencies issue them for state projects. These determinations list the minimum required wage and fringe benefit rates for various labor classifications in a specific geographic area.

- Local Survey Data: Prevailing wage rates are typically based on surveys of wages and benefits paid to workers on similar projects in the area.

Matching Union Rates to Prevailing Wage

For union contractors, compliance with prevailing wage laws is often straightforward:

- Union Rate Exceeds Prevailing Wage: In many cases, the established union wage rates (including the base wage and fringe benefit contributions) meet or exceed the required prevailing wage determination. This simplifies compliance as the CBA already covers the minimums.

- Cash in Lieu of Benefits: If a union contractor’s fringe benefit contributions don’t quite meet the prevailing wage fringe requirement, the difference must be paid directly to the worker in cash, subject to all applicable payroll taxes.

Compliance Challenges

While often simpler for union contractors, challenges can still arise:

- Classification Mismanagement: Ensuring workers are correctly classified according to the wage determination is crucial. Misclassifying a skilled union worker as a lower-paid classification to save money can lead to severe penalties, even if their overall union package is high.

- Accurate Reporting: Detailed payroll compliance and reporting (e.g., certified payroll) are essential to demonstrate adherence to prevailing wage rules and CBA terms.

- Changes in Determinations: Wage determinations can be updated, requiring contractors to stay vigilant and adjust rates accordingly, even mid-project, if the contract allows.

Impact of Union Wage Rates on Your Construction Project

Understanding the direct and indirect impacts of union wage rates is critical for strategic project budgeting and management.

Budgeting and Cost Implications

Higher Direct Labor Costs

As noted, the most immediate impact is the higher per-hour labor cost for union workers due to elevated base wages and mandatory fringe benefit contributions. This needs to be accurately reflected in initial bids and ongoing project budgeting.

Predictability vs. Flexibility

CBAs offer cost predictability for their term, simplifying financial forecasting. However, they can limit flexibility in staffing, promotions, or assigning tasks outside strict trade definitions, which can sometimes lead to perceived inefficiencies if not managed proactively.

Quality, Productivity, and Efficiency

Skilled Workforce Advantages

The investment in apprenticeship programs and continuous training often translates into higher quality workmanship, reduced rework, and improved safety standards. A more experienced and stable workforce can also lead to faster task completion and overall project efficiency.

Potential for Work Rules & Jurisdictional Issues

Strict union work rules or disputes between different trade unions over who performs specific tasks (jurisdictional disputes) can, in some instances, lead to project delays or inefficiencies. Effective project management is needed to mitigate these.

Project Planning and Risk Management

Scheduling Considerations

When planning, contractors must account for potential work rules or specific crew size requirements dictated by CBAs. Efficient scheduling also needs to consider the union’s process for dispatching workers.

Strike Risks

The potential for strikes during contract negotiations is a significant project risk. While rare for an established project, the threat can cause uncertainty and necessitate contingency planning.

Strategies for Contractors: Managing Union Wage Rates Effectively

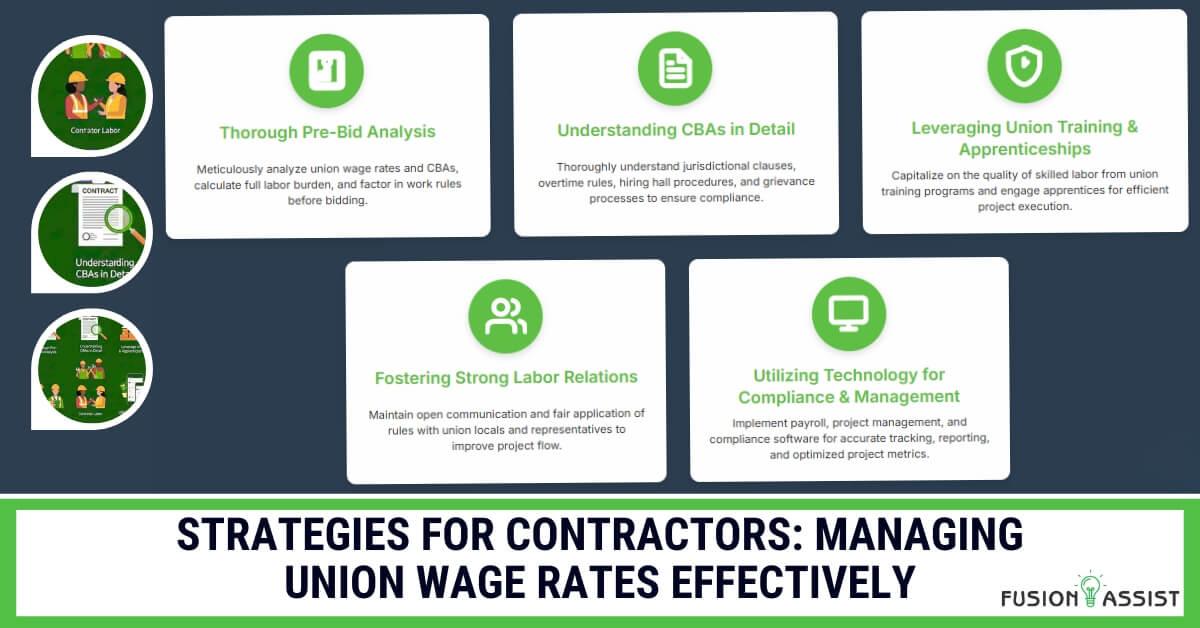

Navigating the landscape of union wage rates requires proactive strategies and robust management practices.

1. Thorough Pre-Bid Analysis

Before submitting a bid, conduct a meticulous analysis of the applicable union wage rates and CBAs.

- Obtain Current CBAs: Secure the most recent CBAs for all relevant trades in the project’s geographic area.

- Calculate Total Labor Burden: Don’t just look at hourly wages; calculate the full labor cost including all fringe benefits, employer contributions, and estimated overtime.

- Factor in Work Rules: Understand the implications of specific work rules on productivity and potential staffing needs.

- Compare to Non-Union: If considering both options, perform a detailed cost comparison against potential non-union labor costs, including their training and benefits.

2. Understanding CBAs in Detail

A thorough understanding of the specific language within CBAs is critical for compliance and avoiding disputes.

- Jurisdictional Clauses: Pay close attention to clauses defining the scope of work for each trade to prevent jurisdictional disputes.

- Overtime and Premium Pay: Be fully aware of all conditions that trigger overtime, holiday pay, shift differentials, and minimum call-out pay.

- Hiring Hall Rules: Understand the procedures for requesting and receiving workers from the union hall.

- Grievance Procedures: Know the established process for resolving any disputes or issues that may arise.

3. Leveraging Union Training & Apprenticeships

Recognize and capitalize on the quality that union training brings.

- Utilize Skilled Labor: Trust in the expertise of union journeymen, which can lead to higher quality work and fewer reworks.

- Apprenticeship Programs: Engage apprentices where appropriate, as they represent a valuable, lower-cost labor pool that is still undergoing structured training.

- Training Funds: Understand that contributions to training funds are an investment in a continually skilled workforce for the industry.

4. Fostering Strong Labor Relations

Positive relationships with union locals and their representatives can significantly improve project flow.

- Open Communication: Maintain clear and regular communication with union stewards and business agents.

- Fair Application of Rules: Consistently apply CBA rules to all workers, demonstrating fairness and integrity.

- Early Conflict Resolution: Address potential issues promptly through established grievance procedures to prevent escalation.

5. Utilizing Technology for Compliance & Management

Advanced technology is indispensable for managing complex union wage rates and associated compliance.

- Payroll Software: Implement payroll systems capable of handling complex union wage calculations, fringe benefit tracking, and accurate certified payroll reporting.

- Project Management Platforms: Use tools that integrate scheduling, resource management, and cost tracking to visualize and manage the impact of union labor on overall project metrics.

- Compliance Software: Leverage specialized software for tracking prevailing wage compliance, ensuring all requirements are met for public works.

Real-World Application: Optimizing Wage Rate Management with Fusion Assist

Effectively managing union wage rates is a challenge that many contractors face, especially on large-scale or multi-state construction projects. This is where comprehensive project management and financial analysis tools can be game-changers.

Consider a general contractor who has won a bid for a new municipal building – a project that requires a substantial skilled workforce and is subject to strict prevailing wage regulations. The contractor is experienced but typically works on non-union projects. To bid competitively and manage risks, they need a clear understanding of the local union wage rates and how they compare to their usual non-union costs, while also ensuring absolute compliance.

Fusion Assist’s integrated project management and financial platform could provide critical support:

Pre-Bid Cost Analysis

Fusion Assist could provide a detailed comparative analysis of labor costs for both union and non-union scenarios, factoring in not just wages but also benefits, training costs, and potential productivity differentials. Their software might simulate project costs under different labor models, giving the contractor a clear financial picture before bidding.

Resource Mobilization & Scheduling

If the contractor chooses to work with a union, Fusion Assist’s project management platform can integrate directly with union hall dispatch systems (where applicable), streamlining the process of sourcing the required skilled workforce. Their tools can optimize detailed schedules, factoring in union work rules and ensuring efficient deployment of specific trades, minimizing potential delays.

Compliance Monitoring

For either union or non-union projects under prevailing wage requirements, Fusion Assist’s compliance features can help automate tracking of worker classifications, hours, and payments against the exact union wage rates or prevailing wage determination. This significantly reduces manual errors and administrative overhead, ensuring seamless reporting and mitigating audit risks.

Risk Mitigation Strategies

Fusion Assist’s risk management modules can help identify, analyze, and plan responses for labor-related risks. This includes modeling the potential impact of labor disputes or jurisdictional issues, allowing the contractor to build contingency plans into their overall project planning.

By leveraging Fusion Assist’s comprehensive project management solutions, contractors can move beyond guesswork. They can make data-driven decisions about their labor strategy, whether it’s embracing a full union workforce, maintaining a non-union structure, or managing a mixed approach, ensuring higher efficiency and successful project outcomes.

Conclusion

Understanding union wage rates is an essential competency for any contractor involved in construction projects. These rates, determined by collective bargaining agreements and influenced by diverse factors, represent a significant component of labor costs and can impact everything from bidding competitiveness to project efficiency and overall success.

By thoroughly grasping the components of union wage rates, how they are negotiated, and their implications for your projects, you can develop effective strategies for managing them. Leveraging a skilled workforce, navigating prevailing wage complexities, and utilizing advanced tools like Fusion Assist can help you make strategic decisions that optimize your operations and drive profitability in the dynamic world of union construction.

Frequently Asked Questions (FAQs)

Q1: What is the primary difference between a union wage rate and a non-union wage rate?

A: The primary difference lies in how they are determined and their components. Union wage rates are set through collective bargaining agreements (CBAs) between a union and employers, covering a standardized base wage plus mandatory, often comprehensive, fringe benefits (health, pension, training funds). Non-union wage rates are typically determined individually by the employer and employee, are more variable, and may include different or fewer benefits.

Q2: How do prevailing wage laws affect union wage rates on public projects?

A: Prevailing wage laws (like the Davis-Bacon Act) require contractors on public projects to pay minimum wages and benefits as determined by the government for specific classifications in an area. Often, union wage rates meet or exceed these prevailing wage requirements, making compliance simpler for union contractors. If union fringe benefits don’t fully meet the prevailing wage fringe, the difference must be paid in cash.

Q3: What is a “labor burden” and how does it relate to union wage rates?

A: Labor burden refers to all the additional costs associated with an employee beyond their direct hourly wage. For union wage rates, the labor burden is particularly significant because it includes mandatory contributions to various fringe benefits funds (health, pension, training, etc.), as stipulated by the collective bargaining agreement. Understanding the full labor burden is crucial for accurate project budgeting.

Q4: Are union workers always more productive than non-union workers due to higher wages?

A: Not always directly because of higher wages, but often due to the comprehensive training and experience associated with union membership. Union construction workers typically go through rigorous apprenticeship programs and continuous training, leading to a consistently skilled workforce. This expertise can result in higher quality work, reduced rework, and greater productivity, which can offset the higher direct wage rates.

Q5: What is a “collective bargaining agreement” (CBA) in construction?

A: A collective bargaining agreement (CBA) is a legally binding contract between a labor union and an employer (or group of employers) that governs the terms and conditions of employment for union members. In construction projects, a CBA typically defines specific wage rates, fringe benefits (health, pension, training), working hours, overtime rules, grievance procedures, and hiring practices for unionized workers on the project. It aims to standardize labor relations and provide stability.