Learn the complete commercial estimation workflow from project review to proposal. Build accurate, profitable bids and protect your margins with Fusion Assist.

A Contractor’s Ultimate Guide to Union Wage Estimation in London

Introduction: Navigating London’s Unionised Construction Landscape

London’s skyline is a testament to relentless ambition, a dynamic canvas where architectural marvels and vast regeneration projects continuously reshape the city’s identity. From the financial powerhouses of the City and Canary Wharf to the transformative urban renewal in Nine Elms and the Olympic Park’s legacy in Stratford, the opportunities for construction contractors are unparalleled. Yet, beneath the surface of this thriving market lies a layer of complexity that can make or break a business: the city’s deeply entrenched and highly regulated unionised labour force. For any contractor aiming to build successfully in the capital, understanding the intricate web of union agreements is not just an administrative task—it’s a critical pillar of financial strategy and operational stability.

A significant portion of London’s skilled construction workforce operates under collective bargaining agreements managed by powerful unions like Unite and GMB. These agreements dictate far more than a simple hourly rate; they are comprehensive documents outlining everything from overtime premiums and travel allowances to pension contributions and specific working conditions. For contractors, navigating this landscape is a fundamental requirement for legal compliance, project harmony, and, most importantly, profitability. An error in calculating these multifaceted labour costs is not a minor oversight that can be absorbed. It is a critical flaw that can trigger a cascade of devastating consequences, including legal challenges, crippling industrial action, and budget overruns that can erase your entire profit margin. In a market as competitive as London, underestimating the true cost of union labour is a direct path to an unprofitable project and a severely damaged reputation.

This guide is for the savvy contractor who understands that winning a bid is only half the battle. The real victory lies in executing the project profitably, professionally, and without dispute. We will delve into why precise union wage estimation is non-negotiable, explore the benefits of getting it right and the immense challenges involved, and break down the key considerations every contractor must master. Furthermore, we will demonstrate how specialised partners like Fusion Assist are becoming an indispensable tool, leveraging technology and expertise to ensure your bids are not just competitive, but profitable and built on a foundation of accuracy.

The Main Benefits of Accurate Union Wage Estimation

While the risks of getting it wrong are severe, the advantages of mastering union wage estimation extend far beyond mere compliance. Accurate labour costing is a proactive strategy that unlocks significant commercial benefits, enhances your company’s reputation, and builds a foundation for sustainable growth.

While the risks of getting it wrong are severe, the advantages of mastering union wage estimation extend far beyond mere compliance. Accurate labour costing is a proactive strategy that unlocks significant commercial benefits, enhances your company’s reputation, and builds a foundation for sustainable growth.

Securing Project Profitability

This is the most direct and crucial benefit. Your estimate is the financial blueprint for your project. When your labour costs—often the single largest variable expense—are calculated with precision, you can bid with confidence. You know exactly what your expenses will be, allowing you to price your services competitively while protecting a healthy profit margin. A precise estimate eliminates the guesswork that leads to “unprofitable wins,” where you secure the contract only to discover midway through that you’re losing money on every hour worked. It transforms your bidding process from a game of chance into a predictable financial exercise.

Enhancing Client Trust and Professional Reputation

In London’s top-tier construction market, sophisticated clients and developers are not just looking for the lowest price; they are looking for reliability and professionalism. A detailed, transparent, and accurate labour estimate is a powerful signal of your competence. It demonstrates that you have done your due diligence, understand the local labour laws, and are capable of managing the project without the risk of disruptive disputes. This builds immediate trust and can be the deciding factor in a competitive tender. A reputation for on-budget delivery and harmonious labour relations is invaluable, leading to repeat business and referrals to other high-value clients.

Ensuring Project Stability and Avoiding Disputes

Wage disputes are the primary catalyst for industrial action. When workers are paid correctly and on time, according to the letter of their agreements, the risk of work stoppages, strikes, or “go-slow” protests plummets. A project free from labour disputes proceeds on schedule, avoiding the catastrophic daily costs of site shutdowns, which can run from £50,000 to over £100,000 on major London projects. This stability is not only financially beneficial but also reduces stress on your project management team, allowing them to focus on construction rather than crisis management.

Strengthening Your Competitive Position

Contractors who master labour estimation can bid more strategically. Knowing your true costs allows you to identify which projects are the right fit for your business and which ones carry too much risk. Furthermore, when you can rely on a fast and accurate estimation process, particularly by partnering with a service like Fusion Assist, you can respond to more tender opportunities without sacrificing quality. This increases your chances of winning the right work—projects that align with your expertise and profitability goals.

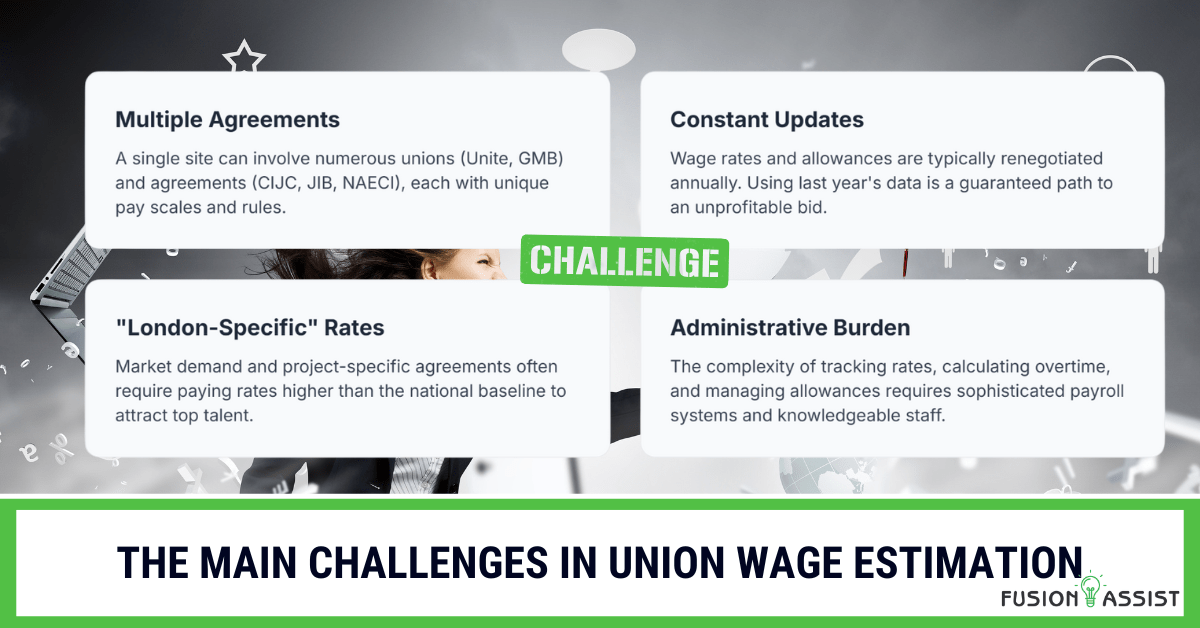

The Main Challenges in Union Wage Estimation

While the benefits are clear, achieving accurate union wage estimates in London is fraught with challenges. The complexity of the regulatory environment requires constant vigilance, deep expertise, and meticulous attention to detail.

While the benefits are clear, achieving accurate union wage estimates in London is fraught with challenges. The complexity of the regulatory environment requires constant vigilance, deep expertise, and meticulous attention to detail.

Navigating Multiple, Overlapping Agreements

A typical large construction site in London is a complex ecosystem of different trades. You may have electricians governed by the JIB (Joint Industry Board) agreement, mechanical engineers and pipefitters under the NAECI (National Agreement for the Engineering Construction Industry), and general builders and civil engineers covered by the CIJC (Construction Industry Joint Council) Working Rule Agreement. Each of these documents has its own unique pay scales, allowance structures, and overtime rules. The challenge lies in correctly identifying which agreement applies to each worker and ensuring your estimate accounts for all the different variables simultaneously.

Keeping Pace with Annual and Ad-Hoc Updates

Union agreements are not static. Wage rates, travel allowances, and other financial entitlements are typically renegotiated annually. These changes are often announced only weeks before they come into effect. Using last year’s rates to bid on a project that will run into the next year is a guaranteed way to under-price your bid. A contractor must have a robust system for tracking these updates across all relevant unions to ensure their estimates are always based on the most current data.

The Ambiguity of “London-Specific” Rates and Project Agreements

While national agreements provide a baseline, the intense demand for skilled labour in London often means that effective market rates are higher. On major infrastructure or high-profile commercial projects, it’s common for a Project Agreement to be negotiated on top of the national agreement, stipulating enhanced pay rates or more generous allowances to attract the best talent and guarantee labour harmony. Failing to account for these unwritten rules or project-specific uplifts can leave your bid uncompetitive or your budget insufficient.

The Hidden Administrative Burden

The complexity of the calculations creates a significant administrative workload. Your payroll team must be able to accurately track different pay rates, calculate complex overtime scenarios, and manage various taxable and non-taxable allowances for every single employee. This requires sophisticated payroll software and knowledgeable staff. The time and resources dedicated to this administration are a real cost to the business that must be factored into your overheads. For a deeper dive into managing these overheads, a resource like “How to Plan Large-Scale Construction Projects” can provide valuable insights.

Key Considerations for Every London Contractor

To overcome these challenges, a compliant and accurate union wage estimate must be treated as a multi-faceted calculation. It requires a granular understanding of several core components that go far beyond a simple hourly rate.

Component 1: Foundational Pay Rates

This is the bedrock of your estimate. You must correctly classify every worker according to their trade and skill level as defined in the relevant agreement. Under the CIJC, for example, rates vary significantly:

- General Operative: The entry-level rate, around £15.00 – £17.00 per hour.

- Skilled Worker (e.g., Carpenter, Bricklayer): A higher rate, typically in the region of £18.00 – £22.00 per hour.

- Advanced Craft/Specialist (e.g., Steel Erector): Can command significantly higher rates, often exceeding £25.00+ per hour, especially in London.

These rates are non-negotiable minimums. For the most current figures, it is essential to refer to high-authority sources like the official Unite the Union or GMB websites.

Component 2: Overtime and Premium Hours

Projects in London rarely run on a simple 9-to-5 schedule. Your estimate must meticulously budget for the premium rates stipulated in union agreements, which are often calculated as:

- Time-and-a-half (1.5x basic rate): Typically for the first four hours of overtime on a weekday and for Saturday mornings.

- Double-time (2x basic rate): For overtime beyond the first four hours, late evenings, Saturday afternoons, and all hours worked on Sundays and Bank Holidays.

On a fast-track project with significant weekend work, these premiums can inflate your labour budget by 20-30% or more.

Component 3: Travel, Fare, and Subsistence Allowances

Union agreements mandate specific, often non-taxable, daily allowances that compensate workers for the cost and time of commuting. The CIJC agreement, for instance, has a detailed schedule based on the distance an operative travels to the site, which can range from £5.00 to over £20.00 per worker, per day. For projects requiring operatives to live away from home, a nightly lodging allowance (e.g., £45.00 – £55.00 per night) is also mandatory. These small daily additions accumulate into a substantial cost over the life of a project with a large workforce.

Component 4: Employer’s “On-Costs”

This is the most frequently underestimated category. For every pound you pay in gross wages, you must account for the additional mandatory costs of employment. These include:

- Employer’s National Insurance Contributions: A significant percentage (currently 13.8%) on all earnings above the secondary threshold.

- Holiday Pay & Entitlement: Workers accrue holiday pay for every hour they work. This is often calculated as 12.07% of their pay.

- Pension Contributions: Mandatory employer contributions under the UK’s auto-enrolment pension scheme.

- CITB Levy: A levy paid to the Construction Industry Training Board to fund industry-wide training. For larger employers, this is typically 0.35% of the total payroll for directly employed staff and 1.25% for subcontractors.

Collectively, these on-costs are a true cost multiplier, adding 25-40% on top of the basic hourly rate. Accurate estimation is the first step in legal compliance. To learn more, it’s wise to consult resources like “Avoiding Penalties: Compliance Tips for Prevailing Wage Laws.”

Real-World Application: A Fusion Assist Case Study

Theory is one thing, but the practical application of these principles under pressure is where specialist services demonstrate their true value.

The Client and the Challenge

A respected medium-sized contractor specialising in high-end commercial interiors won a tender for a fast-track, multi-floor office fit-out for an international bank in a landmark Canary Wharf tower. The project’s success hinged on a compressed 4-month schedule, requiring extensive night-shift and weekend work. The bank, as the end client, had a zero-tolerance policy for delays and labour disputes. The contractor knew that any error in their labour budget would not only destroy their profit margin but also irreparably damage their relationship with a top-tier developer.

The Fusion Assist Solution in Action

Facing immense complexity, the contractor partnered with Fusion Assist. Instead of spending weeks manually deciphering agreements, they uploaded the complete set of project plans and the proposed work schedule to the Fusion Assist platform. The process was swift and precise:

- Digital Takeoff: Fusion Assist’s estimators used advanced software to perform a detailed quantity takeoff, accurately calculating the man-hours required for every task, from installing partitions to complex MEP integrations.

- Database Application: Their proprietary database instantly cross-referenced the required trades with the correct governing agreements. It applied the London-specific JIB rates for the electricians and the CIJC rates for carpenters, plasterers, and general labourers.

- Complex Scenario Modelling: The system automatically modelled the 24/7 work schedule, accurately calculating the immense cost of all overtime, night-shift, and weekend premiums. It also factored in the correct travel and subsistence allowances for every worker based on the site’s location.

- Comprehensive Reporting: Within 48 hours, the contractor received a detailed, bid-ready report. It provided a granular breakdown of costs per trade, a transparent summary of all on-costs (NI, pension, CITB levy), and a total labour cost they could take to the bank.

The Result: A Profitable Win and a Strengthened Partnership

Armed with the Fusion Assist estimate, the contractor submitted a bid that was not the absolute cheapest, but was by far the most professional and transparent. The developer awarded them the contract, explicitly citing their confidence in the bid’s accuracy and the contractor’s ability to manage the project without labour issues. The project proceeded smoothly, with no costly disputes or budget revisions. This success not only resulted in a profitable project but also solidified the contractor’s reputation, leading directly to them being invited to tender for two more projects with the same developer.

Conclusion: Build Your London Business on a Foundation of Accuracy

In the high-pressure, high-reward world of London construction, your labour estimate is more than just a number in a bid; it is a declaration of your competence, a promise to your client, and a commitment to your workforce. It is the financial bedrock upon which successful projects are built. Getting it right is the single most important factor that separates the contractors who build a legacy of profitable, landmark projects from those who constantly struggle with disputes and financial distress. The complexity is immense, the risks are severe, but the path to success is clear. By embracing meticulous detail, staying current with regulations, and leveraging the technological advantage offered by specialist partners like Fusion Assist, you can turn the challenge of union wage estimation into your greatest strategic advantage. Stop risking your profits and reputation on guesswork, and ensure every bid you submit is built on an unshakeable foundation of accuracy, compliance, and confidence.

Turn London’s complex union agreements from a risk into your competitive advantage. Contact Fusion Assist for a fast, accurate, and fully-costed estimate to win your next project.

Frequently Asked Questions (FAQs)

What are the main construction union agreements I need to be aware of in London?

The most prominent is the Construction Industry Joint Council (CIJC) Working Rule Agreement, which is the foundational agreement for over 500,000 workers in the UK, covering most civil and general building trades. For electrical work, the JIB (Joint Industry Board) agreement is the definitive standard. For engineering and mechanical trades, such as pipefitters and welders on industrial-style projects, you will often encounter the NAECI agreement. It’s crucial to identify which agreement applies to each trade on your project.

How often do union wage rates and allowances change?

Typically, the core components of these agreements—wages and allowances—are renegotiated annually. The new rates usually come into force in late June or early July. However, ad-hoc adjustments can sometimes be made. It is a critical business practice to verify you are using the most current version of the agreements when preparing any bid, as using outdated rates from even a few months prior will guarantee an inaccurate and unprofitable estimate.

What is the CITB levy, and do I have to pay it?

The Construction Industry Training Board (CITB) levy is a mandatory payment for most construction employers, designed to fund industry-wide training and apprenticeships. If your total wage bill (which includes payments to both directly employed staff and subcontractors) is over a certain threshold (currently £120,000 per year), you must register and pay. The rate is 0.35% of your total payroll for direct employees and 1.25% of all payments made to subcontractors. It is a significant on-cost that cannot be ignored.

Can I use non-union labour on a major project in London?

While legally permissible, it is often commercially impractical and highly risky on large, high-profile sites in London. Most principal contractors and major developers have project-wide agreements to use only union-affiliated labour. This is done to ensure a consistent standard of skill, maintain site harmony, and prevent the demarcation disputes that can arise between union and non-union workforces. Attempting to use non-union labour on such a site can lead to your workers being denied access or can incite widespread industrial action from other unionised trades.

As a percentage, how much do all the “on-costs” add to the basic hourly rate?

As a reliable rule of thumb, you should budget for total on-costs to add between 25% and 40% to the basic pay rate. The exact figure depends on the worker’s earnings level. For example, a skilled tradesperson on a basic rate of £20.00 per hour does not cost you £20.00. Once you factor in Employer’s National Insurance (~£2.25), holiday pay accrual (~£2.41), and pension contributions (~£0.60), their true cost to your business is already approaching £25.26 per hour, even before considering the CITB levy or any travel allowances.

Accurate Commercial Estimation for Improved Efficiency

Introduction

The fast-changing construction field relies on precise commercial estimation practices for complete project execution success. The budgets and schedules of new shopping mall development, industrial warehouse expansion, and commercial office renovation projects can suffer severe damage when estimation errors occur. Business efficiency relies on precise cost forecasting, the foundation for improvement efforts. Together, we will examine why commercial estimation matters, along with best practices to achieve accuracy, detailed industry examples, and crucial field knowledge, which enables developers, contractors, and property owners to succeed on their projects confidently.

What Is Commercial Estimation?

Forecasting everything needed to build a commercial construction project involves commercial estimation. The process requires detailed mathematical assessments of drawings, specifications, worker fees, material costs and rules, equipment prices, and danger assessments.

Commercial projects differ from residential ones due to multiple reasons, including:

- Larger scales and higher complexity

- Advanced mechanical, electrical, and plumbing (MEP) systems

- Strict regulatory compliance

- Specialised labour requirements

- Project documentation and contract management systems need to be extensive.

Minor errors/mistakes within commercial estimates produce significant financial challenges for businesses.

Why Is Accurate Commercial Estimation So Important?

Accurate project estimation determines how all project execution steps unfold.

- Budget Control: The budget control system maintains realistic financial plans to stop budget overruns.

- Efficient Resource Allocation: The system helps make good use of resources by properly distributing materials, equipment, and workforce.

- Client Confidence: Builds trust through transparency and reliability.

- Competitive Advantage: Enables more precise and successful bids.

- Risk Reduction: Risk Reduction features allow organizations to discover future threats before they become expensive problems.

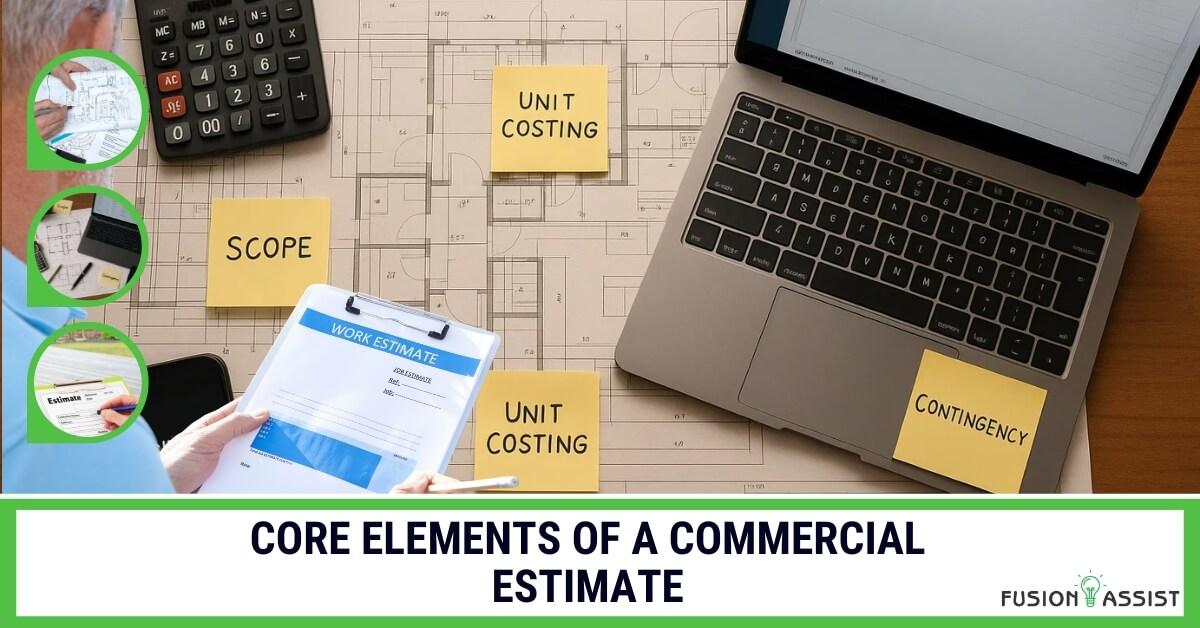

Core Elements of a Commercial Estimate

- Scope Definition: A Clear understanding of project parameters, objectives, and deliverables.

- Quantity Takeoff (QTO): Detailed measurement of all construction components.

- Unit Costing: The pricing approach employs present-day costs of labour, together with materials and subcontractor fees.

- Schedule Estimation: Project timelines will include realistic checkpoints for project milestones.

- Overhead and Profit Margin Calculation: When factoring in costs, organizations must incorporate general business expenses with their desired profit margin.

- Contingency Planning: Allowances for unforeseen circumstances.

- Permits and Compliance Costs: The budget must include the costs of zoning permits, safety codes, and environmental regulations.

Significant Challenges in Commercial Estimation

| Challenge | Impact | Solution |

|---|---|---|

| Incomplete Drawings | Miscalculations and delays | Require complete design sets before final estimate |

| Market Volatility | Material price fluctuations | Use escalation clauses and updated databases |

| Labor Shortages | Project slowdowns and higher costs | Forecast labour availability early |

| Scope Creep | Budget blowouts | Rigid change order management |

| Technological Gaps | Inefficiencies and errors | Invest in advanced estimating software |

The Impact of Poor Estimation: Industry Data

- Commercial projects encounter 73% of cost overruns because early project lifecycle estimations are low.

- Construction projects win more bids when pre-construction estimates reach an accurate level by 22%.

- BIM implementation reduces project estimate accuracy failures to levels reaching 32%.

Proven Strategies for Accurate Estimation

1. Collaboration

Since the beginning of projects, I have collaborated directly with architects, engineers, and consultants to establish precise scope definitions.

2. Database-Driven Costing

Tasks should be estimated using real-time price information and past project data contained in databases.

3. Third-Party Peer Reviews

Independent estimators should join the project for validation purposes while checking for errors.

4. Contingency Planning

Design changes, weather conditions, and supply chain interruptions require permanent cost provisions in all projects.

5. Continuous Learning

Your estimators need ongoing training that helps them predict industry codes, technology changes, and cost trends.

Latest Trends Impacting Commercial Estimation

1. AI and Machine Learning

Artificial intelligence conducts historical analysis to develop precise predictions about project cost forecasts.

2. BIM Integration (Building Information Modeling)

The 3d models generated by BIM technology provide instantaneous updates of material quantities to enhance QTOs.

3. Cloud-Based Estimation Tools

ProEst and Sage Estimating allow remote teams to collaborate immediately through their platforms.

4. Focus on Sustainability

Project costs must incorporate LEED certification, green materials, and energy efficiency standards.

How Technology Enhances Estimation Accuracy

| Technology | Benefits |

|---|---|

| Estimating Software (e.g., ProEst, PlanSwift) | Faster takeoffs, centralized data |

| Drone Surveys | Accurate site analysis and earthwork volume calculations |

| Laser Scanning (LiDAR) | Precise measurement of existing conditions |

| AI-Based Forecasting Tools | Predict material shortages and cost escalations |

Case Studies by Fusion Assist

Case Study 1: Mixed-Use Development – New York City

Background

A major developer proposed building a Manhattan development consisting of retail stores on the first five floors, with residential units above twenty stories.

Challenge

When early planning began, details about higher union labour rates and the logistical complexities of building in a densely populated area were not included.

Solution

The team performed a new cost analysis based on union wages, crane rental fees, and delivery restrictions. We also integrated additional costs for protecting the protected waterway’s environment into our analysis.

Results

- The revised assessment increased by 18%, eliminating the potential for losing business due to underpricing.

- Realistic projection assumptions enabled the deal to secure financing worth $120 million.

- The project finished execution at a cost level that matched the original final projection by 1%.

Case Study 2: Healthcare Facility Expansion – Phoenix, AZ

Background

The healthcare provider required expanding their existing hospital by building a new 100,000 sq. ft. surgical wing.

Challenge

The project faced potential cost increases from unanticipated utility moves and complicated sterile environment standards.

Solution

The project used phased estimation as its approach.

- Conceptual budgeting during schematic design.

- Detailed re-estimates after design development.

- Final bid-stage review incorporating specialty subcontractor inputs.

Advanced laser scanning technology allowed staff to identify utility conflicts before construction started.

Results

- Change orders reduced by 42%.

- The project contingency funds were utilized at a rate of 4% instead of the expected 10%.

- The project finished three months earlier than expected, saving $750,000 for operational start-up expenses.

Conclusion

The accurate commercial estimation process involves more than arithmetic calculations because it requires complete comprehension of project execution systems. Building a link between vision and reality occurs by creating precise commercial estimates that consider site conditions alongside material prices while evaluating labor resources against client expectations.

The present market requires precise estimation, which includes:

- Winning better bids

- Building lasting client relationships

- Successful project completion occurs both within budget and within the scheduled deadline.

- Growing your business sustainably

At Fusion Assist, we blend leading-edge technology, deep industry expertise, and a commitment to detail, offering clients estimates that stand the test of time and complexity. If you’re ready to improve your project’s efficiency and bottom line, partner with a team that values accuracy as much as you do.

Let’s Build Better Together!

Contact Fusion Assist today for comprehensive commercial estimation services designed to ensure your project’s success from the very beginning.

FAQs

Q1. What is the biggest cause of cost overruns in commercial construction?

The main causes of cost overruns in commercial construction projects are scope modifications combined with incorrect assessments of soft costs, such as project permits, insurance premiums, and management expenses.

Q2. Should we hire a professional estimator or use software?

Both! While software provides time efficiencies, professional human estimators deliver the advantage of their expertise, risk assessment abilities, and judgment skills

Q3. What is a good contingency percentage for commercial projects?

A proper contingency percentage for commercial projects typically falls between 5% and 10%. Project risk levels determine the appropriate contingency amount, with healthcare and historic renovation projects needing between 12% and 15%.

Q4. How does location affect commercial estimates?

Urban development sites usually result in increased employee compensation, delivery complexities, and building permit expenses compared with suburban or rural construction efforts.

Q5. Can BIM modeling help estimators?

Absolutely. As design changes occur, updating project quantities dynamically through BIM becomes possible, resulting in precise and faster cost evaluation.

Top Strategies for Managing Costs in Commercial Projects

Introduction

Managing costs in commercial projects is critical to ensuring profitability and success. With numerous variables and potential pitfalls, a well-thought-out strategy is essential. This comprehensive guide will explore the top strategies for managing costs in commercial projects, providing actionable insights and real-world examples to help you navigate this complex landscape.

The Importance of Cost Management in Commercial Projects

Cost management is not just about cutting corners; it’s about optimizing resources to achieve the best possible outcomes. Effective cost management ensures that projects stay within budget, meet deadlines, and deliver high-quality results. By implementing robust cost management strategies, you can mitigate risks, enhance stakeholder satisfaction, and drive business growth.

Key Strategies for Managing Costs in Commercial Projects

Managing costs in commercial construction requires a holistic approach beyond budgeting alone. It involves continuous planning, leveraging innovative techniques, and maintaining strong partnerships. Below are the top strategies that form the backbone of effective cost management in commercial projects.

1. Budget Planning and Forecasting

Accurate Budgeting

Creating a precise and comprehensive budget is the cornerstone of cost control in any construction project. This begins with a thorough estimation of all expenses, including:

- Labor costs (salaries, benefits, subcontractors)

- Material costs (raw materials, prefabricated elements)

- Equipment and machinery

- Permits, inspections, and compliance costs

- Site preparation and utilities

- Administrative and overhead expenses

Best Practices:

- Use historical data from past projects to benchmark expenses.

- Consult with subject matter experts to validate assumptions and cost estimates.

- Factor in market trends such as material price fluctuations or labor shortages.

Regular Forecasting

A static budget becomes outdated quickly in dynamic project environments. Continuous forecasting allows you to adjust financial expectations in response to evolving project variables.

Key Actions:

- Monitor actual vs. projected costs weekly or bi-weekly.

- Update your budget when there are changes in scope, resource availability, or market prices.

- Use forecasting software to create financial models that simulate different scenarios and outcomes.

2. Value Engineering

Identifying Cost-Saving Opportunities

Value engineering is not about cutting corners but maintaining quality while finding cost-effective solutions. This process evaluates each project element to uncover areas where savings can be realized without compromising functionality or aesthetics.

Benefits of Value Engineering:

- Improves cost efficiency

- Encourages innovation and flexibility

- Increases project value and stakeholder satisfaction

Implementation Steps

- Conduct a Thorough Analysis: Break down the entire project into its individual systems (e.g., HVAC, electrical, structural). Review the cost and purpose of each.

- Collaborate with Stakeholders: Involve architects, engineers, contractors, and even vendors. Each party brings unique perspectives that can uncover creative solutions.

- Evaluate Alternatives: Explore multiple materials, construction methods, and layouts options. Compare the life-cycle costs, not just upfront expenses.

Example: Replacing steel beams with engineered timber may reduce costs and offer sustainable benefits without sacrificing structural integrity.

3. Efficient Project Management

Lean Construction Techniques

Lean construction is a project management philosophy that aims to maximise value while minimizing waste. It emphasizes continuous improvement, efficient workflows, and respect for the workforce.

Lean Techniques Include:

- Just-in-time material delivery to avoid storage costs and damage

- Standardizing workflows to reduce delays and confusion

- Prefabrication to reduce labor time on-site

Project Management Software

Project management tools are essential for organizing complex workflows and keeping the project on schedule and within budget.

Recommended Software:

- Asana & Trello: Great for task management and team communication.

- Microsoft Project: Ideal for scheduling and resource allocation.

- Procore or Buildertrend: Industry-specific tools for construction project tracking and financial control.

Implementation Steps

- Adopt Lean Principles: Train your team in lean methodologies like Six Sigma or Last Planner System to ensure a culture of efficiency.

- Use Technology: Utilize software dashboards to visualize project progress, financial health, and resource utilization.

- Regular Reviews: Hold weekly reviews to assess KPIs and take corrective action early.

4. Supplier and Vendor Management

Building Strong Relationships

Vendors and suppliers play a critical role in managing material and equipment costs. Fostering long-term relationships can result in better pricing, priority service, and collaborative problem-solving.

Strategies to Strengthen Supplier Ties:

- Maintain open communication about project timelines and expectations.

- Provide timely payments to foster goodwill.

- Involve suppliers in planning stages for more accurate lead times and cost forecasting.

Implementation Steps

- Negotiate Terms: Focus on price, lead times, payment flexibility, and penalties for delays.

- Bulk Purchasing: Consolidate orders across projects to qualify for volume discounts.

- Long-Term Partnerships: Establish framework agreements with dependable vendors to ensure consistency in price stability and supply chain.

5. Risk Management

Identifying Potential Risks

Early risk identification prevents future budget overruns and project delays. Risks may include labor shortages, equipment failure, weather disruptions, or unexpected site conditions.

Risk Categories:

- Financial: Cash flow, inflation, interest rates

- Operational: Equipment breakdown, supply chain delays

- Legal: Permits, contract disputes, compliance issues

Mitigation Strategies

Proper risk mitigation minimizes the likelihood and impact of negative events.

Examples of Risk Mitigation:

- Purchasing builder’s insurance and liability coverage

- Creating backup vendor lists for critical supplies

- Establishing dispute resolution protocols in contracts

Implementation Steps

- Conduct Risk Assessments: Use tools like SWOT analysis or Monte Carlo simulations to assess probability and impact.

- Develop Contingency Plans: Allocate a percentage of the budget as a contingency fund for high-risk items.

- Implement Quality Control: Set up robust inspection processes to reduce rework and maintain construction standards.

6. Technology and Innovation

Leveraging Technology

Technology is revolutionizing how commercial construction projects are executed. From 3D modeling to drone surveys, these tools enable faster, more accurate decision-making and cost savings.

Key Technologies:

- Building Information Modeling (BIM): Detects design conflicts before construction begins.

- Drones: Provide real-time aerial views for site inspections and progress tracking.

- Virtual Reality (VR): Allows stakeholders to visualize spaces and identify design flaws early.

Implementation Steps

- Adopt BIM: Incorporate BIM to centralize project data and improve coordination between architects, engineers, and contractors.

- Use Drones for Surveys: Save time and labor costs by conducting faster, more accurate site assessments.

- Virtual Reality Design Reviews: Host immersive design sessions with clients and teams to streamline approvals and avoid late-stage changes.

By executing these expanded and actionable strategies, construction professionals can manage costs effectively and deliver higher-quality results that drive long-term project success. Let me know if you’d like these formatted for SEO or turned into downloadable content.

Real-World Examples and Case Studies

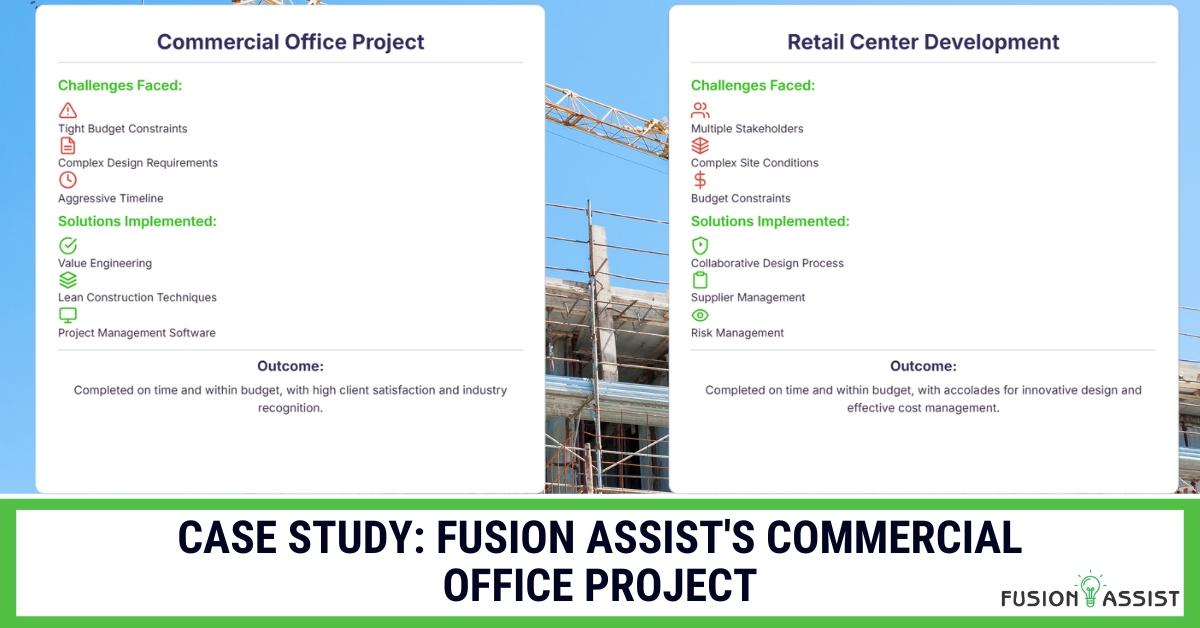

Case Study: Fusion Assist’s Commercial Office Project

Project Overview

Fusion Assist was contracted to build a new commercial office building for a tech company. The project involved a complex design with high-end finishes and advanced technological infrastructure.

Challenges Faced

- Tight Budget Constraints: The client had a strict budget, making cost management critical.

- Complex Design Requirements: The project required specialized materials and advanced construction techniques.

- Aggressive Timeline: The project had to be completed within 12 months to meet the client’s occupancy schedule.

Solutions Implemented

- Value Engineering: Fusion Assist conducted a value engineering exercise to identify cost-saving opportunities. They proposed alternative materials and design modifications that reduced costs without compromising quality.

- Lean Construction Techniques: They implemented lean construction techniques to optimize resource allocation and reduce waste. This included just-in-time material delivery and efficient workflow management.

- Project Management Software: Utilizing project management software, they tracked progress in real-time, identified potential delays, and took corrective action promptly.

Outcome

The project was completed on time and within budget. The client was highly satisfied with the results, and the project received industry recognition for its innovative approach and cost management strategies.

Case Study: Fusion Assist’s Retail Center Development

Project Overview

Fusion Assist was tasked with developing a new retail centre. The project involved multiple stakeholders, complex site conditions, and a tight budget.

Challenges Faced

- Multiple Stakeholders: Coordinating with multiple stakeholders, including retailers, suppliers, and local authorities, was a significant challenge.

- Complex Site Conditions: The site had challenging terrain and required extensive grading and stabilization.

- Budget Constraints: The project had a strict budget, making cost management essential.

Solutions Implemented

- Collaborative Design Process: Fusion Assist fostered a collaborative environment between architects, engineers, and stakeholders. Regular meetings and open communication channels helped align all parties and identify potential issues early.

- Supplier Management: They developed strong relationships with suppliers, negotiating favorable terms and securing bulk purchase discounts.

- Risk Management: A thorough risk assessment identified potential risks, and mitigation strategies were developed to address them. This included purchasing insurance and implementing quality control measures.

Outcome

The retail center was completed on time and within budget. The project received accolades for its innovative design and effective cost management strategies.

FAQs

How can I reduce costs without compromising quality?

Value Engineering and Lean Construction Techniques

Implement value engineering to identify cost-saving opportunities without compromising quality. Utilize lean construction techniques to optimize resource allocation and reduce waste.

What role does project management software play in cost management?

Tracking Progress and Identifying Delays

Project management software helps track progress in real-time, manage resources efficiently, and identify potential delays. This proactive approach allows you to take corrective action promptly and avoid cost overruns.

How can I negotiate better terms with suppliers?

Develop Strong Relationships and Explore Bulk Purchasing

Develop strong relationships with suppliers and explore bulk purchasing options to secure better pricing and service. Long-term partnerships can also lead to additional benefits such as timely deliveries and priority support.

What are the benefits of using Building Information Modeling (BIM)?

Enhanced Efficiency and Decision-Making

BIM enhances efficiency by identifying design conflicts early, optimizing construction sequences, and improving decision-making. This results in reduced rework and cost savings.

How can I manage risks effectively in a commercial project?

Conduct Thorough Risk Assessments and Develop Mitigation Strategies

Conduct a thorough risk assessment to identify potential risks and develop mitigation strategies. Allocate contingency funds where necessary and implement quality control measures to prevent defects and rework.

Conclusion

Managing costs in commercial projects is a multifaceted challenge that requires a strategic and proactive approach. By implementing robust cost management strategies, leveraging technology, and fostering collaboration, you can optimize resources, mitigate risks, and deliver high-quality results. Whether you are a project manager, contractor, or stakeholder, understanding and applying these strategies is essential for achieving project success.

Contact Fusion Assist to streamline your commercial project costs through expert planning, innovation, and proven results