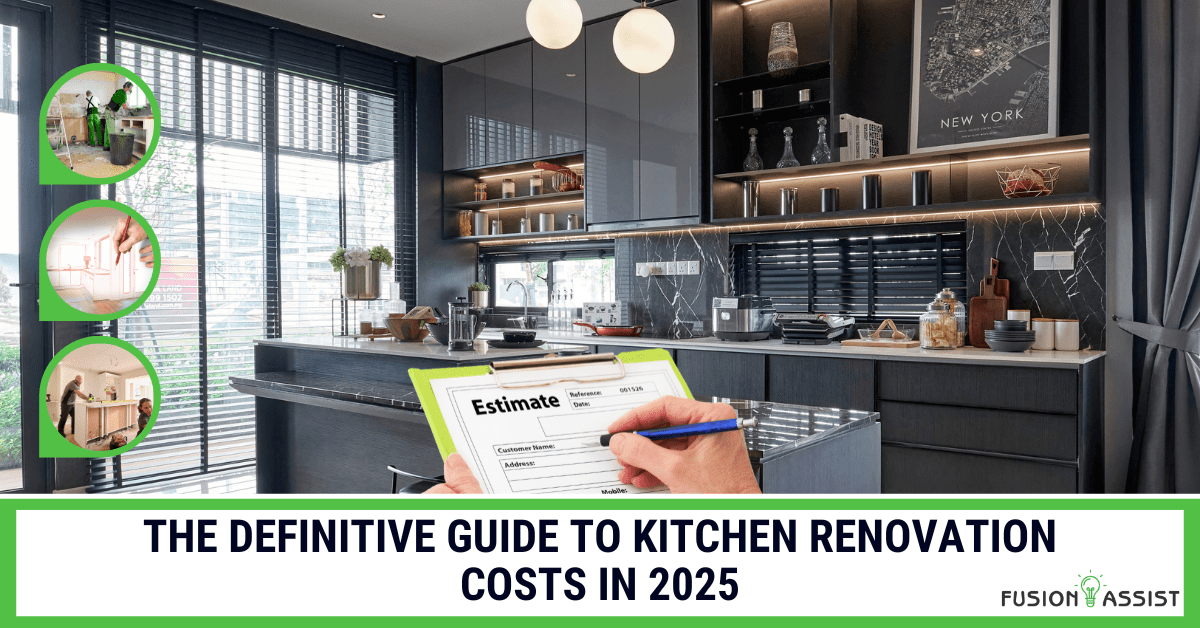

Introduction

Bathroom can be considered one of the smallest room in a house, yet, undoubtedly, one of the most complicated and costly to remodel in terms of dollars per square foot. When it comes to understanding renovation cost bathroom trends, even a basic remodel can surprise both homeowners and contractors with its complexity. It is a pressure cooker of an atmosphere in which a dozen various trades may intersect in a small area; plumbing, electrical, framing, drywall, waterproofing, and beautiful tile work. One slightly wrong estimate in plumbing arrangement or a forgetful waterproofing system may cause disastrous leakages and eliminate your profit margin altogether.

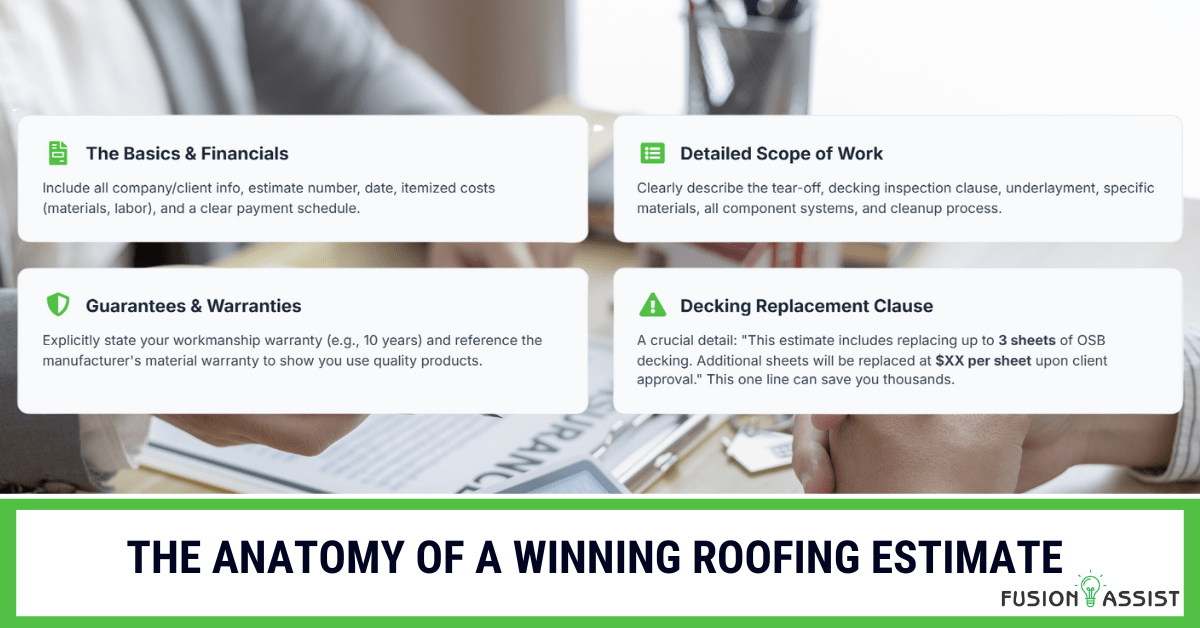

Homeowners look at a thing of beauty that is the finished space, you look at the truth behind it all: an intricate maze of systems that have to work perfectly. Your estimate is the document, which fills that gap. It has to be a masterclass in detail, which warrants the expensiveness of good work and cushions your business against the huge risk factor.

This guide has been prepared with the professional contractor in mind, that is, you. We are going to break down the bathroom remodel budget item by item, look at the true cost of all types of bathroom remodels, including a basic powder room and a sumptuous master suite, and tell you how to write bids that will not only get you profitable work, but will also make you a recognized expert.

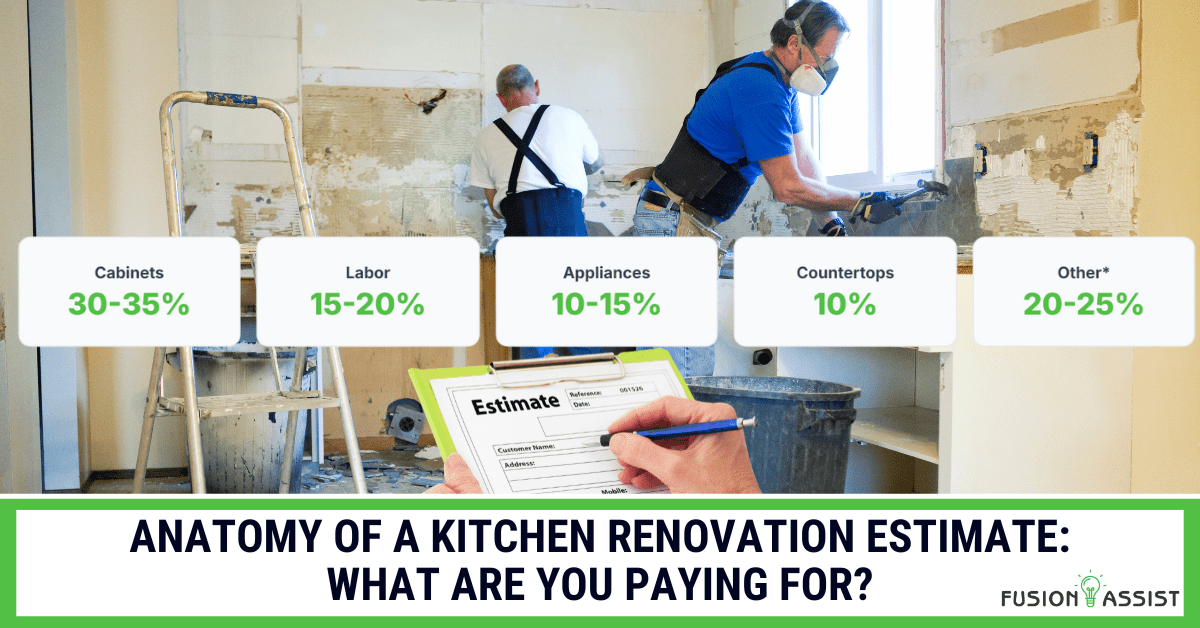

Deconstructing the Bathroom Budget: Where Does the Money Go?

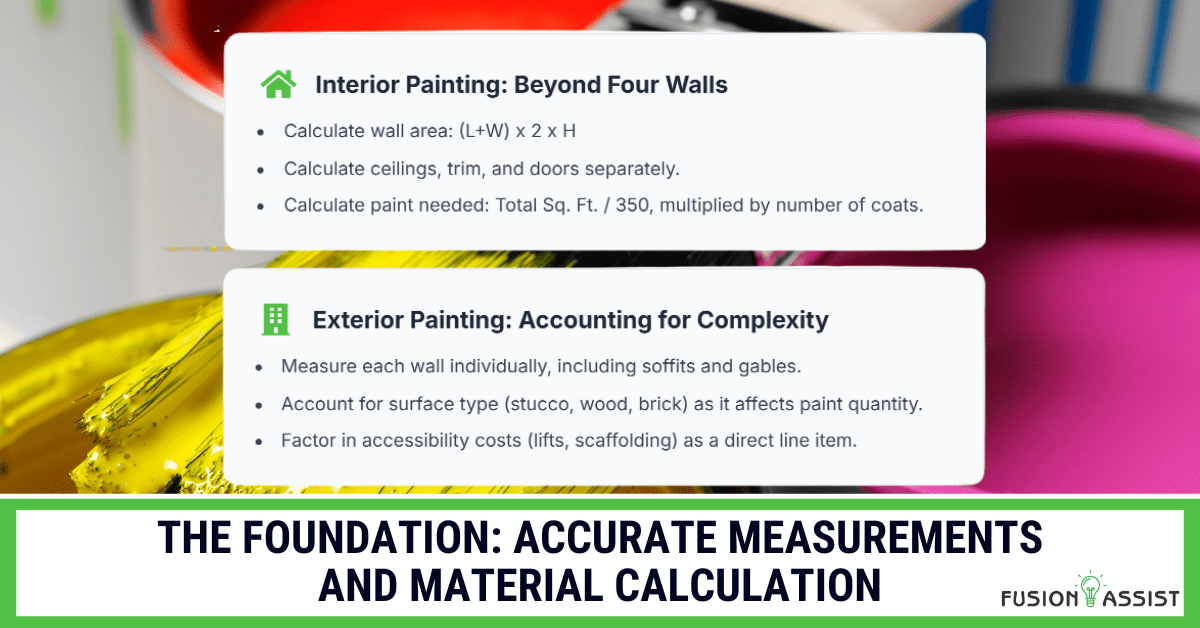

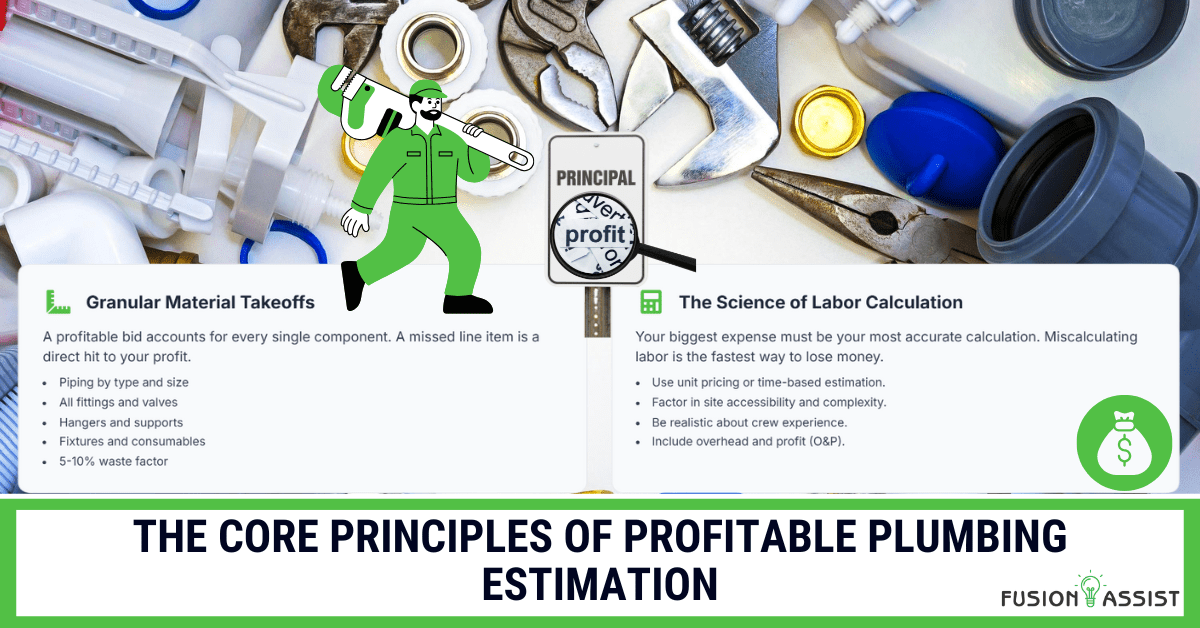

The first step in creating an accurate bathroom renovation estimate is understanding the bathroom renovation cost distribution. Unlike a simple bedroom where the cost is mainly paint and flooring, a bathroom’s budget is dominated by fixtures, tile, and highly skilled labor. If you were to create a pie chart of a typical mid-range bathroom remodel, it would look something like this:

- Labor (20-25%): It can be the single biggest item. It includes the demolition, plumbing, electrical, carpentry, tiling and painting.

- Tile (15-20%): The cost of the tile itself and all the associated materials (thin-set, grout, sealant) and the highly skilled labor for installation.

- Vanity & Countertop (15%): This is a huge center of attention and has a big variety of prices.

- Plumbing Fixtures (10-15%): This includes the shower system, faucets, sink, and toilet.

- Waterproofing & Substrate (10%): The unseen but absolutely critical system behind the tile.

- Other (15-20%): This covers everything else: lighting, ventilation fans, mirrors, medicine cabinets, permits, and debris disposal.

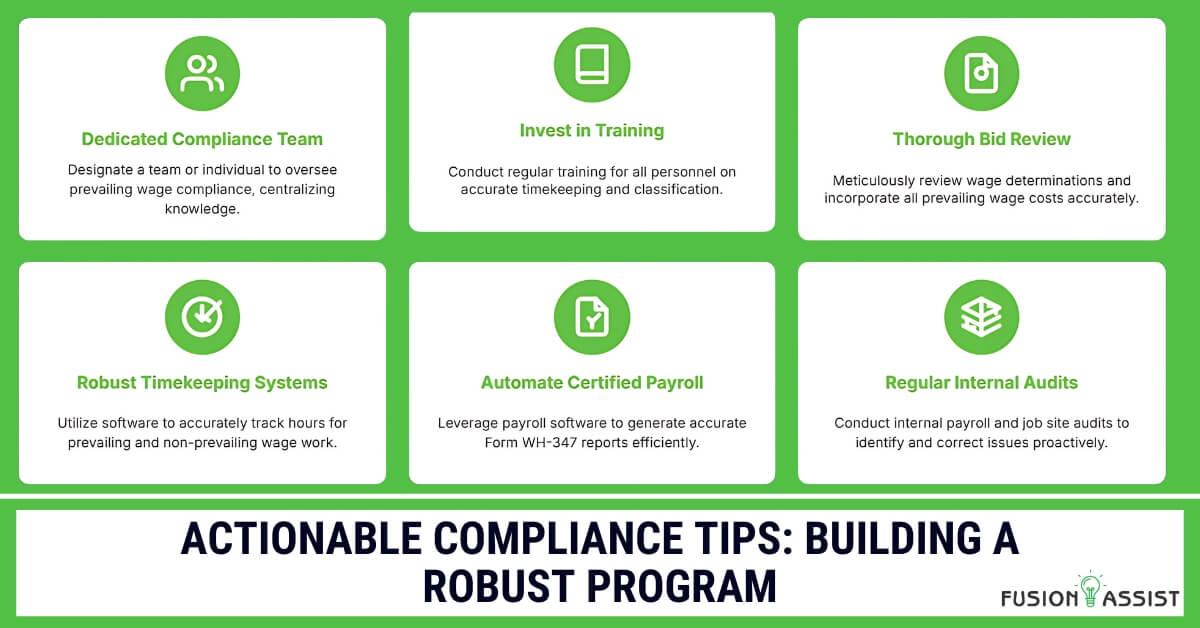

The Skilled Labor Costs: A Convergence of Trades

Bathroom remodel is a graduate course in project management. You are organizing several licensed trades within a tight area. Your labor estimate should take into consideration the time it will take to:

- A licensed plumber to move drain lines and install a new shower valve.

- A licensed electrician to add a new circuit for a heated floor or run wiring for sconces.

- An experienced tile setter to perform elaborate designs and a waterproofing that is foolproof.

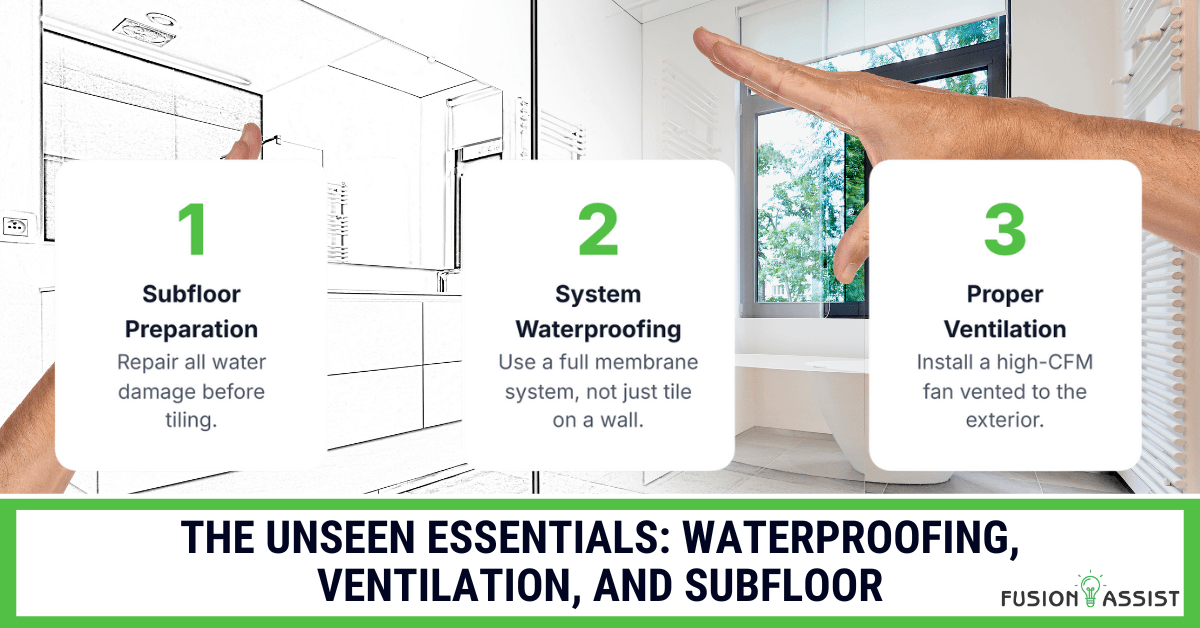

The Unseen Essentials: Waterproofing, Ventilation, and Subfloor

It is here that amateurs foul up and professionals earn their salaries.

- Waterproofing: The present day shower is not simply tile on a wall, but rather an entire system. This involves waterproof shower pan, a membrane (such as Schluter-KERDI) on the walls and sealed joints. It is a non-negotiable multiple steps procedure that involves additional material and labor expenses but eliminates disastrous leaks.

- Ventilation: The code requires proper ventilation and this is also necessary in prevention of moulds and mildew.This entails the placing of a high-CFM (cubic feet per minute) exhaust fan that is properly vented to the outside.

- Subfloor Preparation: Checking for and repairing any water-damaged subfloor before tiling is critical for a lasting installation.

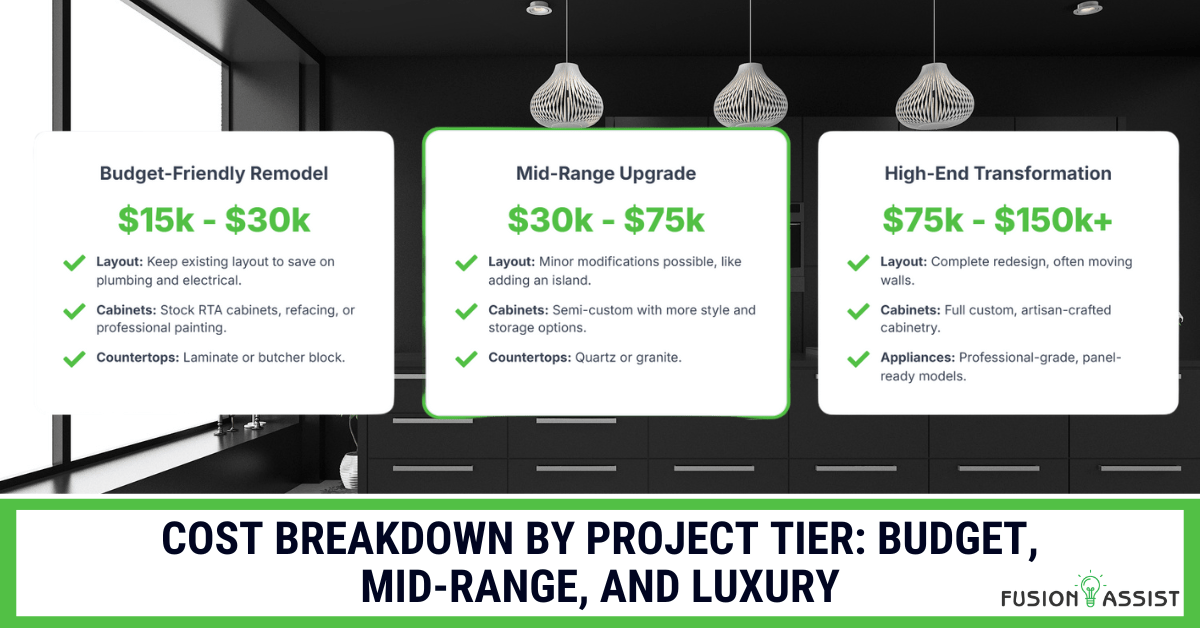

Estimating by Bathroom Type and Scope

Bathroom remodel could include anything to replacing a faucet to blowing out walls. In order to develop a precise estimate, the scope should be defined. We’ve broken it down into three common project tiers.

The Powder Room Refresh: $4,000 – $10,000

The Powder room or half-bath is the least expensive and easy bathroom project. The project is usually cosmetic in nature and leaves all the plumbing where it is.

- Scope: No layout changes. It is concentrated on the renovation of surfaces and fixtures.

- Work Involved:

- Changing the vanity, counter, sink and faucet.

- Installing a new toilet.

- New flooring (can be a small space, so a good spot to use a fashionable tile).

- New lighting fixture, mirror and paint.

- Contractor Focus: This is a great starting point to understand renovation cost bathroom for smaller-scale updates. These are great, quick-turnaround projects. Efficiency is the key and an estimate that is simple and clear defining replacement of specific pre-selected items is the key to profitability.

The Guest Bathroom Gut: $10,000 – $25,000

It is the most typical full bathroom renovation. It is a complete renovation of a typical 5×8 bathroom but typically not changing the footprint.

- Scope: Complete tear-out of all existing fixtures and finishes. Some small plumbing or electrical changes can be made but relocating load-bearing walls is not in the scope.

- Work Involved:

- Replacing a tub-shower combo with a new tub and a tiled surround.

- New tile flooring that is waterproofed.

- New, usually bigger, vanity to have a stone counter.

- New water closet, washbasin, tap and shower fittings.

- Contractor Focus: The most critical item at this is proper cost estimating of the tile work, and the plumbing behind the walls. A detailed understanding of the plumbing work involved is critical, a topic we cover in-depth in The Plumbing Estimating Masterclass.

The Master Suite Oasis: $25,000 – $75,000+

It is a luxury, renovating project in which costs allow the use of high-end materials and considerable modifications of the layout. Here the skill and reputation of a contractor comes to the fore.

- Scope: Frequent relocation of walls to increase the footprint of the bathroom. Redesign of the layout completely.

- Work Involved:

- Walk-in Curbless Shower: This is a grand aspect and will involve a lot of waterproofing and floor re-construction to make a smooth and barrier free entry.

- Freestanding Tub: A statement piece that requires specific plumbing rough-in.

- Double Vanity: Custom or high-end semi-custom cabinetry with dual sinks.

- Luxury Materials: Natural stone floor covering (marble, travertine), quartz counter tops and high quality plumbing fixtures.

- Premium Features: Running warm floors, steam shower systems, custom glass enclosures, individual toilet chambers and designer lighting.

- Contractor Focus:This tier requires a sharp focus on planning and a perfect execution to make profits. The bid should be remarkably comprehensive to grip the price of each luxury item and the intricacy of the custom-made work. A project like this is a core component of a high-value home renovation, a concept explored in our True Cost of a Home Renovation Guide.

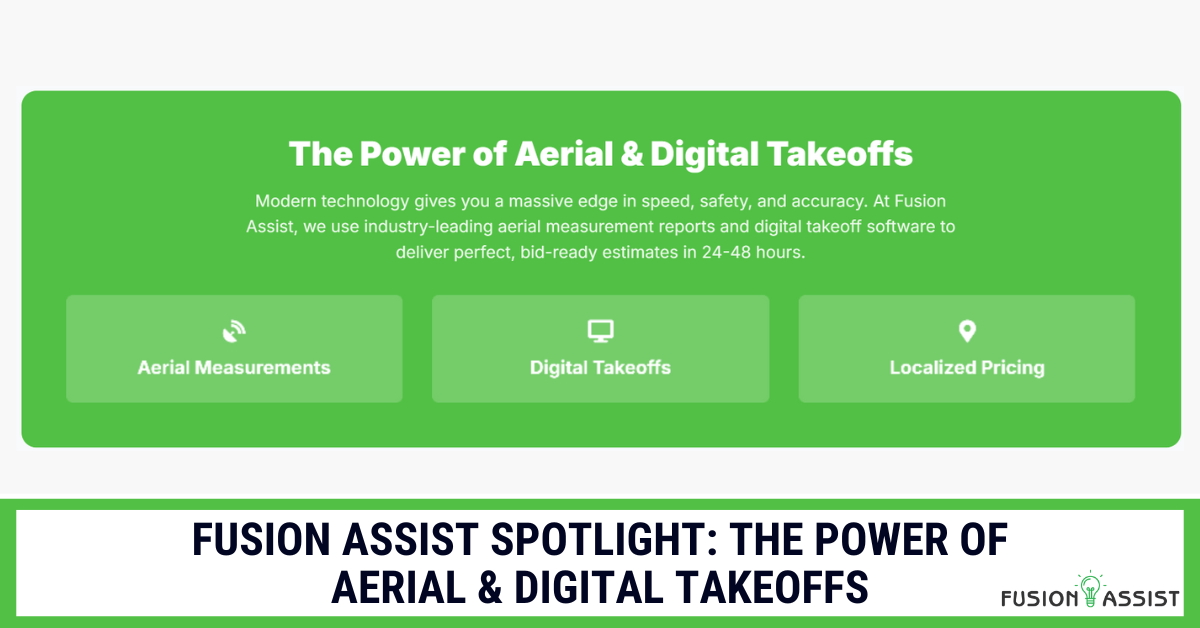

Fusion Assist Spotlight: From Tile Counts to Winning Quotes

Bathroom estimating is an inch game and a game of details. The process of counting each tile, each fitting and each fixture manually is excruciatingly time consuming. And one little slip up, such as forgetting the price of a fancy schmancy shower valve or misjudging the labor on an intricate tile pattern can cost you hundreds or even thousands of dollars.

Fusion Assist avoids that risk and saves you time. It is our specialty to break down complicated bathroom plans into hyper-detailed estimates that are accurate.

- We Sweat the Details: We do a full takeoff and consider absolutely everything: the square footage of tile needed to cover the floor, the walls and the shower niche; the linear feet of trim pieces; the precise number of plumbing and electrical fixtures; and the amounts of waterproofing membrane, thin-set and grout that will be required.

- We Price for Profit: We use localized and up to date pricing on all of your material and labor items so that when you bid on a job, you are covering your actual costs and paying you the profit you want to make on the job.

- We Help You Win: A Fusion Assist estimate is an estimate that is powerful in sales tools. When you can give a customer a professional, line item bid on their luxury bathroom project it places you heads and shoulders above other contractors who can only give a vague quote. It shows you are a serious professional who respects their investment. This level of detail is a cornerstone of any successful bidding strategy.

Case Study: A Luxury Master Bath Project

Client

A high-end residential remodeling contractor.

Challenge

The contractor was tendering a master bathroom remodel project worth 60,000 dollars and above. This project featured a curbless walk-in shower with a linear drain, a free standing tub, and marble tile on the floor to ceiling. The customer was thorough and preferred to see a breakdown of all the renovation cost bathroom. To secure the job, the contractor was supposed to come up with a perfect bid.

Fusion Assist Solution

The contractor had posted the architectural plans and finish schedule on our portal. A careful takeoff was done by our team. We have determined the precise amount of square footage of marble tile we will need including the intricate cuts needed to produce the shower niche as well as the pitched floor to meet the linear drain. We added the price of the particular high-end plumbing fixtures off of the spec sheet and the entire Schluter waterproofing system. The estimate also listed the labor intensive installation of the large-format marble tile.

Result

We provided a multi pages, line item estimate breaking out each and every element of the project. This was provided to the homeowner by the contractor who took him/her through the prices of the waterproofing, plumbing and tile work. The transparency and professionalism were so appreciated by the homeowner that they offered the bid without any negotiation, although it was not the lowest price they received. The contractor was featured in a local design magazine as the project was a huge success.

Conclusion: Build Beautiful Bathrooms Without Ugly Budget Surprises

Stop absorbing the costs of unforeseen complexity. Let Fusion Assist help you manage every renovation cost bathroom component with confidence. Build beautiful bathrooms and a stronger business with estimates you can trust. Contact Fusion Assist to get your next bathroom estimate.

Frequently Asked Questions (FAQs)

Which is the largest hidden expense in bathroom remodel?

Water damage is nearly always the largest hidden expense. You never know what you are going to find until you open up the walls and floor and find rotted subflooring, moldy studs or even leaking pipes that could not be seen previously unless you demolished it. These discoveries ought to be dealt with by a healthy contingency fund (15-20%) and a well-defined change-order procedure.

What is the price of toilet relocation?

The cost of relocating a toilet is among the highest changes you can undertake. It will run between one thousand five hundred and three thousand five hundred dollars or more because it involves cutting into the concrete slab or re-doing the floor joists in order to relocate the large 3- or 4-inch drainpipe.

Do curbless, walk-in showers cost more to construct?

Yes, significantly. The actual curbless shower needs the floor of the whole bathroom to be effectively sloped and waterproofed. Floor structure must be recessed to receive the slope and this makes the curbless shower considerably more expensive in structural and labor costs than a typical curbed shower.

Do I need a permit for a bathroom remodel?

You might not require a permit, though, when you are merely swapping out fixtures in their current positions (like-for-like). But when you are switching the layout, relocating plumbing or electrical, or making any other changes to structural elements, you most definitely will require a permit, so that the work is safe and matches the building regulations.

What is the best way to waterproof a shower?

While there are several methods, a topical sheet membrane system, such as that offered by industry leader Schluter Systems, is considered a best practice by many high-end contractors. It creates a continuous, sealed layer directly behind the tile, preventing any water from reaching the wallboard or studs.